The term ‘know your customer’ can be used in many aspects of business from marketing to sales, however in financial and regulatory sectors, the term is mainly used for due diligence and compliance terms.

What does it mean to know your customer? Know your customer policies, also referred to as KYC is, in simple terms, the process of verifying the identity of your clients before doing business with them.

It is a mix of screenings that differ company to company, mostly including ID verification, identifying the ultimate beneficial owner (UBO), PEP and Sanction screening, Anti-Money Laundering (AML) screenings, plus more.

The term KYC is also sometimes referenced as AML processes within regulated sectors, both are a similar process during the onboarding of a new customer.

Regulated sectors are required by law to have a KYC policy within their onboarding process, and many other businesses are following suit to combat criminal activity. The ‘know your customer’ process is best described as an umbrella term that has various due diligence and compliance checks within it. Although it is not mandatory for all businesses, they are vital to prevent your business from falling victim to fraud.

Why do we need ‘know your customer’ policies?

In the UK, the Money Laundering Regulations 2017 offers advice to companies on how to stay compliant, however, every industry will have a different governing body regulating and driving KYC policies. If your business is covered by the Money Laundering Regulations you need to carry out customer due diligence measures to check that your customers are who they say they are and carry out a risk assessment before working with them.

Know your customer policies are fundamentally there to protect your business from falling victim to fraud and losses due to dealing with illegal transactions. KYC checks have been expanding and evolving for some time, with criminal activity such as corruption, terrorist financing, and money laundering continuously growing; KYC policies have now evolved into an imperative tool to protect financial institutes across the globe.

You could face possible fines, bad publicity and even be sanctioned if you have failed to carry out this compliance and are found to be doing business with a terrorist or money launderer.

What is a KYC policy?

Know your customer policies will differ from company to company, but many begin by collecting basic data and information about their customers, mostly using electronic identity verification. This information will then be screened against databases to confirm the person is who they say they are.

This information will also be screened against a list of individuals that are known for criminal activity and corruption, and/or individuals on a sanction list. If there is a match on any of these lists it would be strongly advised not to work with these individuals to protect your own business.

Individuals will also be screened against the Politically Exposed Person (PEP) lists; ensuring they are not an easy target for bribery or at a high risk of money laundering.

After all these checks have been carried out, you should have a good idea of how much risk working with a client holds, and from there be able to decide on whether or not to continue your business relationship.

Keeping a record

You need to keep records of all the due diligence measures you carry out, governing bodies recommend having a minimum 12-month record of due diligence. Some documents you would need to retain include:

- Customer identification documents you’ve obtained

- Risk assessments

- Your policies, controls and procedures

- Training records

It is also very useful to have a compliance tool that details all the measurements you have taken out, giving you an audit trail of every step to show you have complied if your business ever comes under investigation. Compliance checks are also recommended to be re-run regularly, with full details being kept for reference.

A full Compliance tool at your fingertips

KYC checks can be a long, drawn-out process; especially if it is being done manually. Many companies will have a team of people checking potential clients, and even with some dropping off due to risk, you will still lose those hours of labour. Not to mention this will also, in addition, hit your bottom line. If your know your customer policies are slowing down the onboarding process, finding a way to streamline the workload to make it more efficient and cost-effective may be the best answer for you.

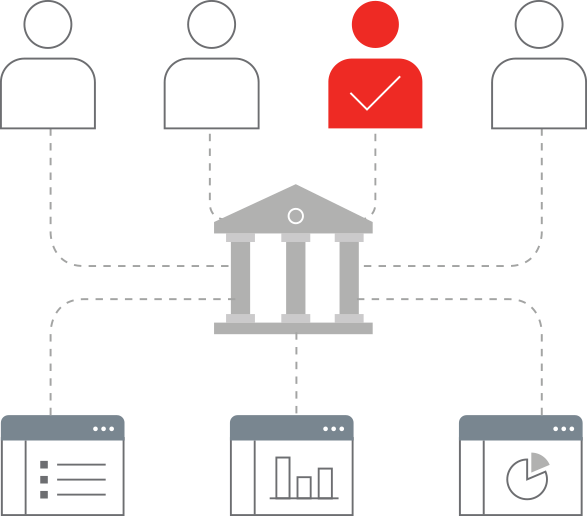

Creditsafe’s Risk and Compliance tool streamline the KYC process, alongside ID verification, UBO verification, running PEP & Sanction screenings and AML screenings; it also offers news reports regarding the company in question from raw data. Matching data to various sources including Lexis Nexis, Creditsafe’s compliance reduces the manual hours of your on-boarding process by managing multiple policies for multiple jurisdictions, thus also reducing human error.

Our tool has a single view of a customer from multiple data sets. Complete with a full dashboard to manage your portfolio, get a click by click, time-stamped audit trail on all your compliance checks.