Our priority is to support you and other finance professionals in making the right credit decisions while building resilience to the economic impact of the Covid-19 crisis. The global pandemic has shown us that it has never been more important today to screen, control, monitor and credit check your business relationships (and markets). Problems in potential supply chains, challenges in reliability and the financial resilience of companies are key organisational concerns for everyone's credit and risk organisation.

Free COVID-19 impact assessment

Get a better understanding of the impact of the corona crisis on your customer and supplier portfolio with a free COVID impact assessment from Creditsafe on Belgian companies.

With the help of these additional COVID-19 impact analyses we can support you in implementing new credit policies that support you, your customers and your supply chain.

At present, it is difficult to assess Covid-19 credit risks due to the unprecedented situation in which entire industry sectors are affected and due to the increasing financial aid programmes set up by governments to provide additional support in an attempt to prevent companies from going bankrupt.

Still, credit risk management decisions must be made every day, which is why we have created the Covid-19 Impact Assessment solution to provide additional guidance on commercial credit in these uncertain times.

Coronavirus customers and suppliers risk mapping for Belgium

CFOs, Credit Managers and other financial professionals can use this additional risk data to quickly identify risk areas within their portfolios.

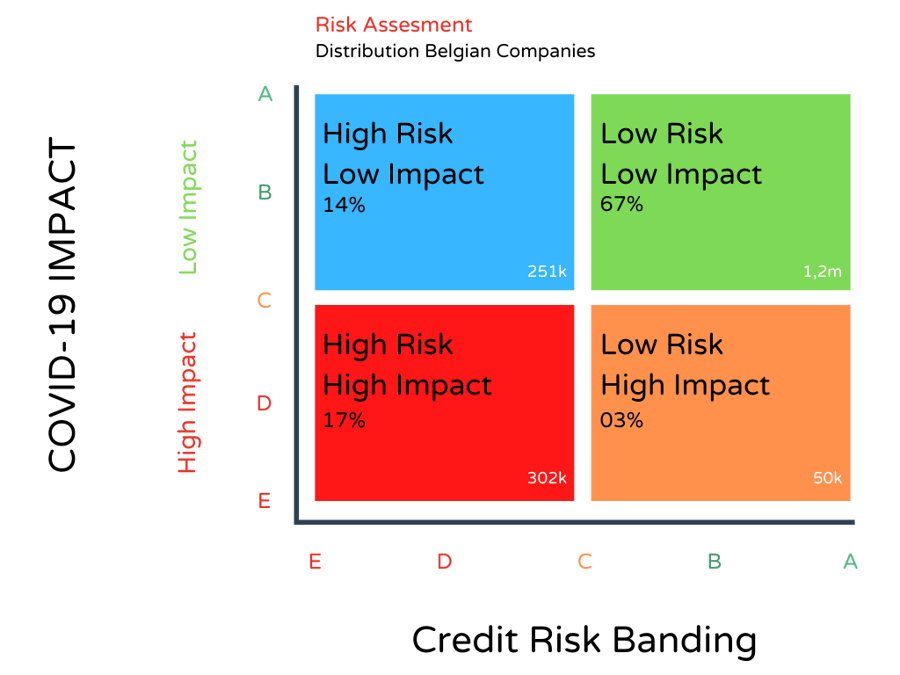

Companies with a healthy 'financial immune system' are more resilient to the impact of Covid-19 on their industry. These companies are also more likely to recover more quickly. Therefore, we use an impact/risk matrix that maps the impact of the Covid-19 crisis against the financial strength of companies.

Creditsafe's analysis of Belgium shows that between 30% and 40% of Belgian companies are likely to experience significant business disruption within the next 90 days.

The "Impact Indicator" differs from Creditsafe's usual credit score, which predicts the likelihood of bankruptcy or insolvency in the next 12 months and as such should be used as an additional guidance indicator in these challenging times.

Our assessment allows you to:

-

Protection

Minimise risk and secure business opportunities by segmenting your portfolio into an easy to understand credit risk strategy.

-

Action

Determine appropriate and immediate actions based on a risk assessment matrix of your customer and supplier portfolio.

-

Insights

Create insights to develop a credit continuity plan to secure and support your customers now and in the future.

Creditsafe wishes to support its customers and companies during this troubling period by offering a free Covid-19 Impact assessment on Belgium to help identify hidden risks in your customer and supplier portfolios.

Business and credit risk action model

The Impact Indicator was developed by combining macro- and micro-economic indicators, national and local data, along with payment data and other company data elements.

This COVID-19 impact indicator assesses the likelihood of a company's disruption on a simple scale, ranging from A - very low risk of disruption to E - very high risk of catastrophic disruption.

-

High risk / low impact

It is recommended to include these customers in follow-up lists & increase the accounts receivable monitoring system. Implement stricter delivery and payment terms. Credit check of all orders before shipment is advise and reduce commercial activities.

-

High risk / severe impact

Maximise company monitoring. Reduce and eliminate outstanding debts. Eliminate trade credit facilities or install new payment terms. Short-term cessation of commercial activities is appropriate.

-

Low risk / low impact

Increase cash flow and focus your commercial efforts on these customers. Increase business activity and increase commercial actions. Always check the debtors carefully. Maintain normal conditions as much as possible.

-

Low risk / Serious impact

Support and cherish these customers. Maintain normal terms and conditions as much as possible. Check the debtors at regular intervals and build strong commercial relationships. These customers will probably recover quickly.

Review your customer or supplier portfolio in 3 easy steps

-

Upload a file

Send us a file with a list of customers or suppliers, in complete confidentiality.

-

Report generation

We will match your file and generate a portfolio impact report.

-

Strategy evaluation

Optimise your strategy and stay alert for future changes.

Request your free COVID-19 impact assessment via the link below and a Creditsafe representative will contact you. All we need is a list of the customer or supplier accounts you wish to have assessed.

Naturally, we treat each file with the necessary discretion and confidentiality. Your files will never be shared with third parties.