Accurate credit decision is based on qualitative data. Why is a new model needed?

The market is changing and so is our way of classifying risk. Different types of companies differ more today compared to ten years ago, both in terms of available information and risk exposure. Therefore, there is a need of continuously review our score models and re-evaluate the way we predict risk.

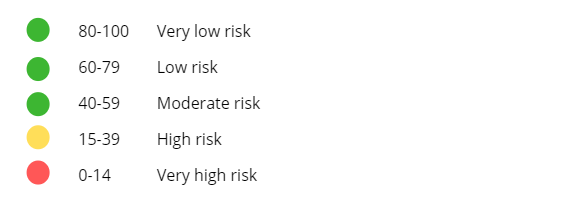

The new rating will be based on more models than before and will thus be more accurate in the various segments. We will go from three to six models for limited companies based on available data and size. Hundreds of variables have been complied and we have looked at the weighting of each variable along with the impact, to give you a even higher precision in your credit assessment.