One key reason why you might be paying invoices late is that your own customers aren’t paying their invoices on time. It’s a cyclical effect. If they pay their invoices late, that affects your own cash flow and your ability to pay your suppliers/vendors on time.

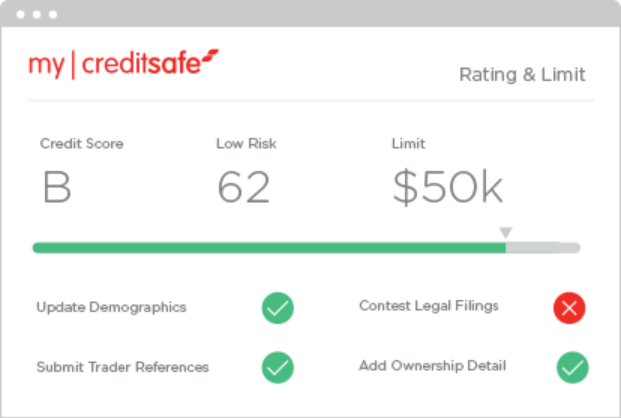

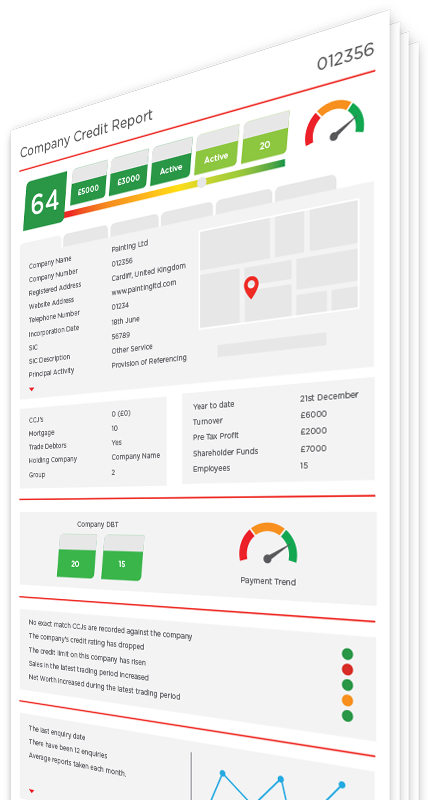

So, what’s the answer then? Technology. More specifically, you should use a ledger management tool to get the full picture of your company’s financial health. And make sure that this tool integrates with an international database of risk management. That is double the power and insights for your business.

By doing so, you’ll be able to see exactly which customers are in collections and can put a plan in place to get those payments sooner than later.

How will using a ledger management tool help you?

- You’ll get the full picture of your customers’ payment patterns. That means you can spot gaps, create processes to get paid sooner and even make decisions to stop working with habitually late payers.

- You can set more realistic payment terms to cut down on the amount and frequency of late payments.

- Get a clear sense of where your debt is and where you can make changes.

- Set up alerts to monitor when your cash flow falls below a certain threshold. That will help keep your cash flow healthy.