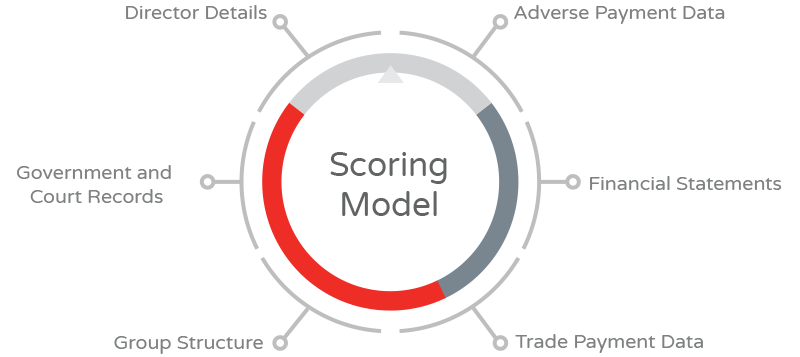

Data analysis is at the very core of what we do at Creditsafe. Our industry-leading scoring system includes key statistical metrics and the most advanced statistical techniques to help determine the financial stability of a company.

Credit Scores & Limits

Financial Data

Director Information

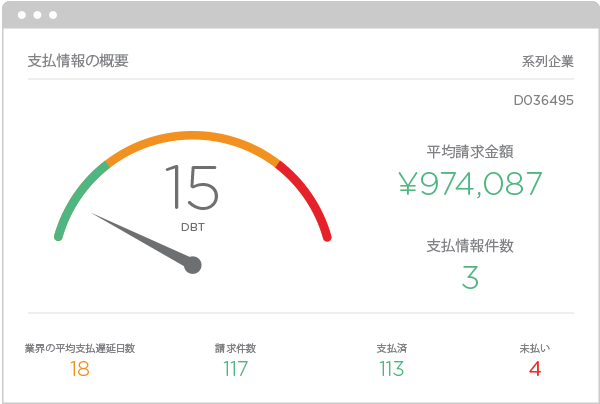

Invoices & Payments

We obtain financial data through official sources such as government entities, and also Creditsafe direct investigation.

Acquired financial information is recorded for up to three terms, and includes the following.

- Balance Sheet

- Profit & Loss Account

- Other Financials & Ratios

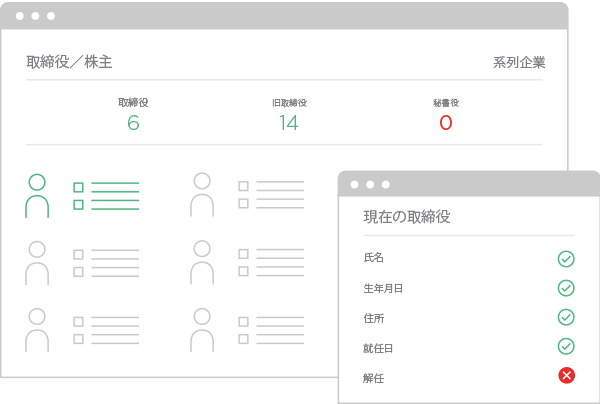

In order to gain a better insight into how a company operates, you need to know more about the people running the business, including their history

Through our director information you can expect to find the following:

- Name

- Month and Year of Birth

- Nationality

- Appointment and Resignation Dates

- Current and Previous Directorships

Information on our reports is not everything.

We provide you more company details by Fresh Investigation based on your request.

Key Features

-

Objective Credit score

Rating by people often brings personal feelings that distort facts; however, our credit rating is calculated mechanically by a predetermined algorithm.

-

Unlimited Use of Japanese Company Reports

Over 5m company's credit reports available online for unlimited.

-

Fresh Investigation

Gathering the most up to date information available by directly Investigate.

-

Negative Information

Information includes bankruptcies, Judgments, and Lawsuits.

-

Up to 3 years of Annual Accounts

Analyse your customers’ financial performance over the past 3 years including Balance Sheet, Profit & Loss, and Account Other Financials & Ratios.

-

Group Structure

View ultimate and parent holding company information, including those overseas and possible linkages.

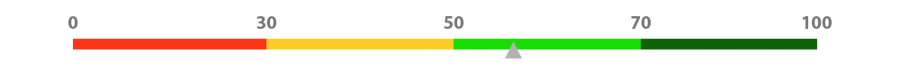

Credit Score

Our score is designed with simplicity in mind so you can make a credit decision as fast as possible.

The score measures the likelihood of a company becoming insolvent within the next 12 months.

- 71-100 - Very Low Risk

- 51-70 - Low Risk

- 31-50 - Moderate Risk

- 0-30 - High Risk

- E - Not Rated

Where Does the Data Come From?

The data used to create our scores and limits comes from not only official sources such as government entities and the registered office but also Creditsafe independent investigation.

Monitoring Service

With Creditsafe’s Monitoring Service, you’ll never again miss vital changes to the companies that you do business with. The system is highly adaptable and allows you to customize the alerts you receive to ensure that you’re only getting the most relevant notifications for your business needs.

-

Get updates information

Receive email notifications on any changes to companies you are doing business with.

-

Organize your alerts

Create portfolios of the companies you want to monitor and receive instant alerts to any changes

-

Export updates

Export your entire portfolio with all of the up-to-date business information appended. You can select the information that you want to see from 17 different categories.

Credit Report Packages

Choose the right package for your business

Choose from three packages designed to help you increase sales and reduce credit risk.

We also provide a customization plan based on your usage situation.

Check Company Credit Score and Report for Free

Frequently Asked Questions

The Creditsafe scoring model works on a scale of 1-100 and predicts the likelihood that the business will go bankrupt within the next 12 months.

Because information is constantly changing, it is difficult for Credit Safe to keep up-to-date information about every company. If the company you are looking for is not found in our database, we will start a fresh investigation and deliver the latest detailed report within 5-10 business days.

Your business credit score is calculated using the most sophisticated statistical algorithms available - taking into account over 150 parameters as well as economic and industry factors.

99.9% of all reports requested by our customers are typically delivered instantly online. When a company report is not available a fresh investigation will take between 5-10 business days depending on the country.

Powering the World's Leading Businesses