Creditsafe offers a truly global risk management solution featuring company data and analytics from businesses around the world. We’ve built the world’s largest owned database of more than 365 million business reports across 100+ countries. Instantly tap into our database to assist fast and data-driven decisions, helping you grow your international business with peace of mind.

International Business Credit Reports

Almost all report requests will be delivered instantly online, and for any others, we'll provide you with a freshly investigated company report.

-

Over 320m credit reports available instantly online

-

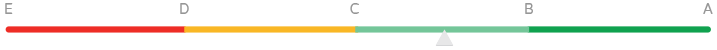

A – E International credit score for easy comparison

-

99.9% of requested reports delivered instantly

Standardised International Scoring

To make things easier for you when trading internationally, we have created an international score.

An international score allows you to compare company credit scores across the world, and will provide you with peace of mind, regardless of which country you are trading in. By using the same scoring range and risk descriptions for all countries, we make it even easier for you to compare reports.

Our score is designed with simplicity, ranging from A-E; A being the lowest risk, D being the highest risk and E being unrated. It measures the likelihood of a company becoming insolvent within the next 12 months.

- A - Very Low Risk

- B - Low Risk

- C - Moderate Risk

- D - High Risk

- E - Not Rated

Real Time Monitoring Alerts

Maximise your protection with company changes delivered to your inbox.

Company Monitoring helps you to keep a close eye on your customers and suppliers without the need to regularly check their company reports. Simply add them to monitoring and if there are any changes to the company, you will receive an email notification. This tool could lead to saving you both time and money; allowing you to spot the warning signs and act before it's too late.

Easily add companies to your watch list from within our company credit reports

- Afghanistan

- Austria

- Belgium

- Bosnia & Herzegovina

- Bulgaria

- Cambodia

- Canada

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Hungary

- Ireland

- Italy

- Japan

- Kosovo

- Laos

- Latvia

- Liechtenstein

- Luxembourg

- Macedonia

- Malaysia

- Moldova

- Montenegro

- Myanmar

- Netherlands

- Norway

- Poland

- Romania

- Serbia

- Slovakia

- Slovenia

- South Korea

- Spain

- Sweden

- Switzerland

- Thailand

- UK

- Ukraine

- USA

- Vietnam

Our Credit Report Packages

Choose the right package for your business

Choose from three packages designed to help you increase sales and reduce credit risk.

We also provide a customization plan based on your usage situation.

Try Credit Check an International Company for Free

Join the 110,000 companies that use Creditsafe to grow and protect their business.

Frequently Asked Questions

Our international business credit reports include most of the information you would expect to find in a local report. We sometimes need to gather information from other local sources, so the information may vary country by country.

Our data has collected from over 200 sources that including official registries. Our network of 16 offices allows us to collect information locally, ensuring we always deliver fresh information.

When a company report is not available to view online, you have the opportunity to freshly investigate a business. Once this request is received, we will attempt to contact the company directly using our network of local partners and official registries to provide a detailed international business credit report within as little as 5–10 working days.

Because not all countries use a 1-100 score; using an A-E score makes it easier for you to compare the credit risk of companies from across different countries. A is the lowest risk, D the highest risk, and E is unrated.

Almost all reports requested by our customers are typically delivered instantly online. When a company report is not available a fresh investigation will take between 5-10 business days depending on the country.

Creditsafe international database reports are updated in real-time, over 1 million times a day.

Powering the World's Leading Businesses