Among the factors that have created changes and challenges for businesses are the ongoing effects of the pandemic, global business trends such as inflation and climate objectives, the rise of emerging economies, trade conflicts, the challenging position of the Eurozone and the economic uncertainty caused by the Brexit.

We are in a persistent period of doubt and in a renewed playing field for Risk Management with new and changing elements. Your current risk management policy is up for renewal and new risk calculations need to be made this year. Risk analyses need to be expanded with a greater reliance on the availability of new data, more indepth judgements and the benefit of experience.

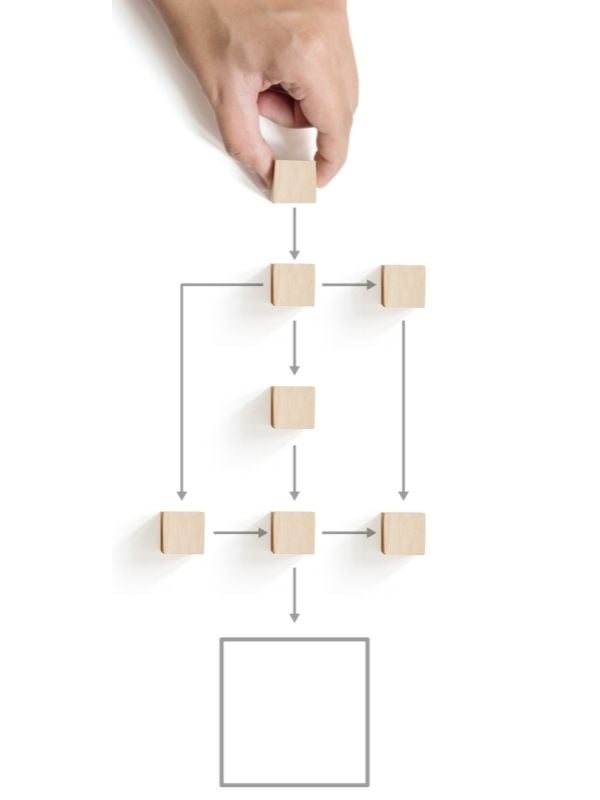

To support Risk & Credit management teams, we have listed the main topics and trends they need to be aware of from 2022 onwards and which need to be addressed in order to stay ahead in this constantly evolving market.