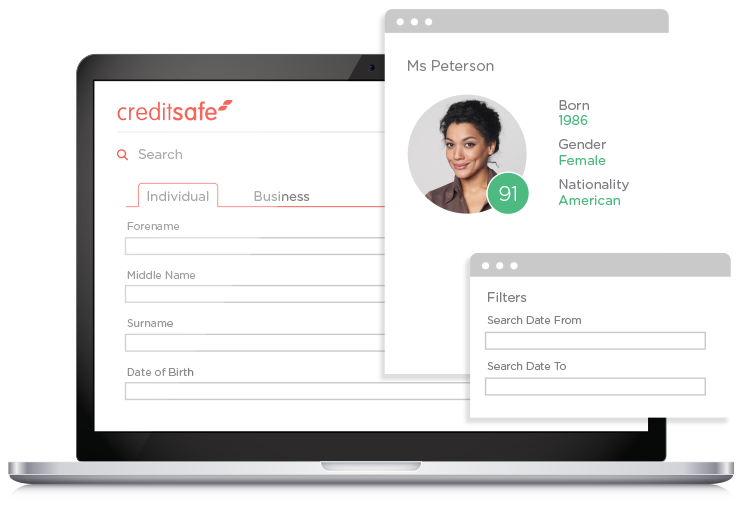

Creditsafe Trace helps customers to quickly find a person or debtor that they have lost track of. Utilising a collection of official records and databases, Creditsafe Trace perform a person 'lookup' to identify, investigate and confirm the identities of individuals.

It’s fast and simple, customer enters the last known details such as a name, address and date of birth and immediately receive a report detailing linked addresses, residency judgement data and deceased details allowing customer to confidently find a person in seconds.

Creditsafe Trace has different options to use it effectively based on customer use case. With the Bulk Trace feature, customers can find multiple people or debtors in one go. And for customers looking for an automated way of tracking down their gone-away clients, powerful Trace API integrates easily with their CRM or Accounting systems.

Creditsafe assures that any consented data published within Creditsafe Trace has been lawfully obtained and that it conforms to GDPR