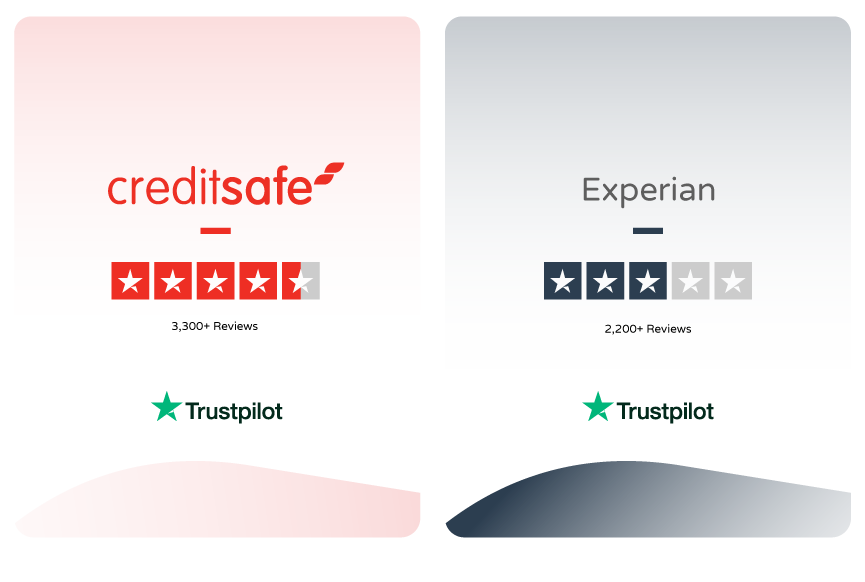

Tap into Creditsafe’s database of over 430 million company reports across 200+ countries and territories directly from your CRM, ERP or accounting system.

Enrich records automatically with up-to-date business data.

Monitor customers and suppliers without leaving your existing workflow

Automate decisions with plug-and-play apps or flexible APIs.