Collaborate, automate and simplify your accounts receivable management

Ledger Insights consolidates your workstream into a single platform

-

Evaluate Portfolio Health

Visual dashboards show you the health of your ledger at a glance. Compare it to other divisions, product streams or your wider industry.

-

Reducing Bad Debt

Enhance your Ledger with risk data to initiate risk-based collections that focus on the likelihood of payment rather than simply age of debt.

-

Accelerate Credit Approvals

Automate credit and compliance-based checks with Check & Decide to save up to 70% of decision time and improve customer experience.

-

Compare Payment Experiences

View how your customers are paying you compared to other suppliers in your industry, your corporate group or the entire market.

-

Pre-Built Reporting

Have a clear view of your risk position at any time with 20+ pre-built management reports to easily view and share with stakeholders.

-

Access Unique Debtor Insights

Receive exclusive alerts, warnings and trade references about your debtors from your colleagues & industry peers.

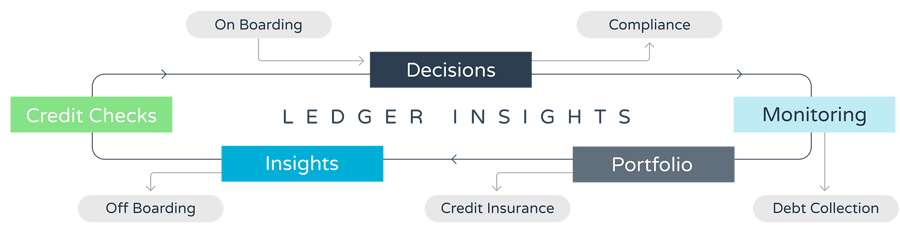

Effortlessly manage your customers throughout their credit lifecycle

Better manage risk and maximize returns with new debtor insights for every touchpoint

Exclusive access to discussion forums and member alerts

Collaborate and share insights with your peers, inside or outside of your organization

-

Share Debtor Experiences

Alert one another to debtors that have become uncontactable, have been submitted for an insurance claim, had their account suspended or had their debt written off.

-

Request a Trade Reference

Request further information on a debtor from your community peers in order to make an informed lending decision.

-

Coordinate Community Events

Organise and share details of community events. Members will be notified of events such as webinars, group meetings and conferences

Fast, seamless & secure integration with 1000s of software packages

Set up in a day and start optimizing your portfolio

Connect your data with Ledger Insights in 4 easy steps

We help you get set up within a matter of hours

Automated (cloud-based packages)

Automated (on-premise packages)

Manual Upload

Our partner Codat provides a seamless and secure connection between your accounting package and Creditsafe.

Search for your accounts package connector via Codat.

Download & install the designated Connector App.

Enter your unique license key into your account package.

Instantly begin the secure data exchange with Creditsafe.

Our partners Osmo & DBasics provide a seamless and secure connection between your accounting package and Creditsafe.

Speak to the Creditsafe Trade Payment Data Team to begin your set-up.

Share the details of your accounting package with us.

We connect you with the dedicated support team at Osmo or DBasics.

Your automated upload will be set-up in an hours call with Osmo or DBasics.

This is the recommended process for testing before moving onto an automated data exchange.

Speak to the Creditsafe Trade Payment Data Team to begin your set-up.

Export your client and transaction files from your accounting package.

Drop the file onto our SFTP, our team will pick it up and map the fields.

Repeat the process daily to ensure fresh data is powering Ledger Insights.

We adhere to the highest security standards

As your trusted partners in business intelligence and risk mitigation, Creditsafe’s dedicated Security teams prioritise safeguarding your data. From robust encryption in transport and at rest to rigorous external penetration testing to our internal audit function, we ensure your data is protected with the appropriate levels of confidentiality, integrity, and availability.

Our Security Operation Centre (SOC) swiftly address any cybersecurity threats. We invest in Security Engineering, continuously advancing our controls and technologies and our Compliance team ensures that security policies are seamlessly integrated into our company culture through user training and awareness. They also manage our audit schedule and Business continuity programmes.

We continue to expand our resources and experts within Creditsafe with additional analysts, auditors, compliance workflow software and external consultancy. To recognise the high security standard we hold, we are proud to be ISO21001 certified since 2015 and targeting SOC2 Type 2 compliance by mid-2025. Penetration tests can be provided on request, and a roadmap showing key milestones and timescales is available for review.

Additional information can be found and requested via Trust.Creditsafe.com

Data privacy is central to our Trade Payment Data Program

By joining Ledger Insights, you are welcomed to Creditsafe’s Trade Payment Data (TPD) Program, a network of thousands of businesses actively sharing anonymous payment history. Together our TPD Network gain deeper insight into the behaviour of their debtors to safeguard their businesses, while also also supporting a more transparent marketplace.

Creditsafe handles Trade Payment Data with the upmost respect and in line with data privacy legislation. The data is collected and processed under the proper permissions of legitimate interest. Usage of data is fully mapped throughout the business and subjected to rigorous risk and data protection impact assessments as well as Legitimate Interest Assessments. We do advise businesses sharing trade payment data with Creditsafe stipulate that they do so in their contracts and, or applications.