To credit check a company you need to inspect their business credit report. A business credit report will have elements such as a credit score, recommended credit limits, payment data and more. Credit report providers like Creditsafe offer additional features such as analytics, dashboards, global credit scores, business automation tools and more. They can also integrate into any CRM or ERP using their proprietary API.

Company Scores and Ratings

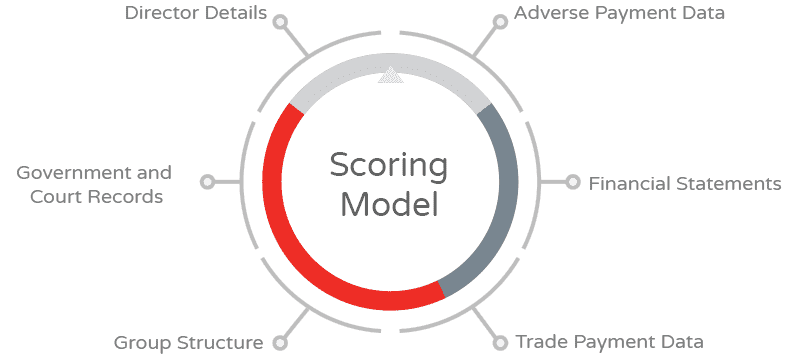

With our scoring model, we can predict 70% of company bankruptcies 12 months in advance, saving you the financial worry that bad debt brings.

Every business is also assigned a Creditsafe International Score. This is a standardized score derived from the Creditsafe rating. It enables credit risk comparison of over 430 million businesses worldwide.

-

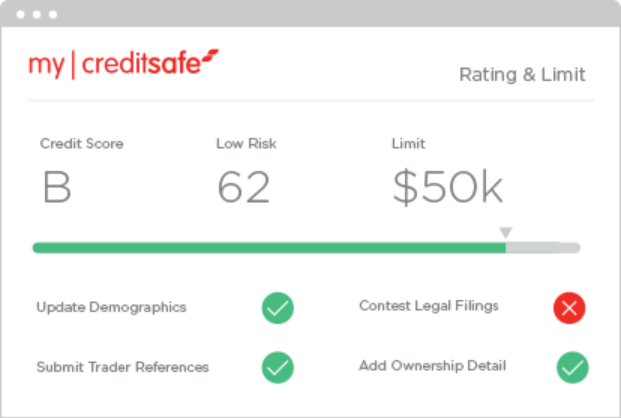

Credit scores & limits

All our reports contain a business credit score and a suggested credit limit.

-

Group structures and linkages

Corporate hierarchical structure identifying the head office, parent companies, subsidiaries and branches at a global level.

-

Payment trends and DBT

Our trade payment analysis that highlights how many days late a company pays their bills and how it compares to their industry.

-

Derogatory legal

Check the number and value of tax liens and judgment filed in the last 6 years and 9 months plus bankruptcies filed in the last 9 years and 9 months.

Enhanced Financial Data

Financial Trade gives unprecedented insight into the health of small and micro businesses so that Credit Managers can make the most informed decisions possible

Unique to Creditsafe you can request access to Financial Trade Data which includes accounts such as:

-

Business lease

-

Commercial credit card

-

Letter of credit

-

Line of credit

-

Open ended line of credit

-

Term loan

A world of information

Get instant access to commercial credit information on 430 million companies worldwide, delivered instantly online through our network of 26 offices across North America, Europe and Asia.

-

Worldwide coverage

Instant credit reports on 365 million businesses worldwide.

-

24/7 monitoring

Real time notifications of credit risk changes delivered direct to your inbox.

-

Officer Information

See the officers of each company and identify other know affiliations.

-

Possible OFAC

Flag sanctioned businesses that the U.S. government prohibits from trading with under the Patriot Act.

-

Trade Line Analysis

Identify and analyze outstanding credit commitments and payment behaviors.

-

Dedicated support

Training & support delivered through dedicated account management.

Creditsafe is very much worth the yearly investment for us. It is imperative to be able to continually check in on the credit status of your open accounts. As the AR Manager who wears many different hats, Creditsafe puts the information as an easy-to-access and understand report and alert. I plan on renewing year after year.

BAI Distributors Inc.

Run a free business credit report

Simply click below to view a credit report on any company for free.

What is a company credit check (AKA. Business Credit Report)

Why should you credit check a company?

You should credit check a company using a full business credit report. A business credit report is a powerful strategic asset used for B2B risk mitigation and profitable decision-making.

Its core value is providing a predictive view of a customer's reliability, enabling you to maximize sales by confidently setting appropriate credit limits. This protects your cash flow from bad debt, ensuring you only engage with financially stable and reliable partners for sustainable business growth.

What to look for when you credit check a company

There’s a lot to look out for when credit checking a company, but here are some top picks:

- Contact Details – When doing business with a new company you want to make sure that they are legitimate. Always check that the registered details align with who the company present themselves as, and look into the company officer/s as well.

- Credit Score – Most credit checks will provide you with a credit score, and an explanation of how that score relates to risk. E.G. Creditsafe provides US businesses with a score of 1-100, 100 being low risk and 1 being very high risk.

- Payment Trends – A good credit check will give you insight into a company’s payment history. This is important because late payments can be an early warning sign of bankruptcy, and it also help you tailor the payment terms you offer to improve you cash flow.

- Recommended Credit Limits – Alongside a score, most company credit checks will offer recommended credit limits. These give you an indication of the maximum amount of trade credit that you should extend to a company.