We know trade credit can be a competitive advantage for your business. We’re here to make it easy for you.

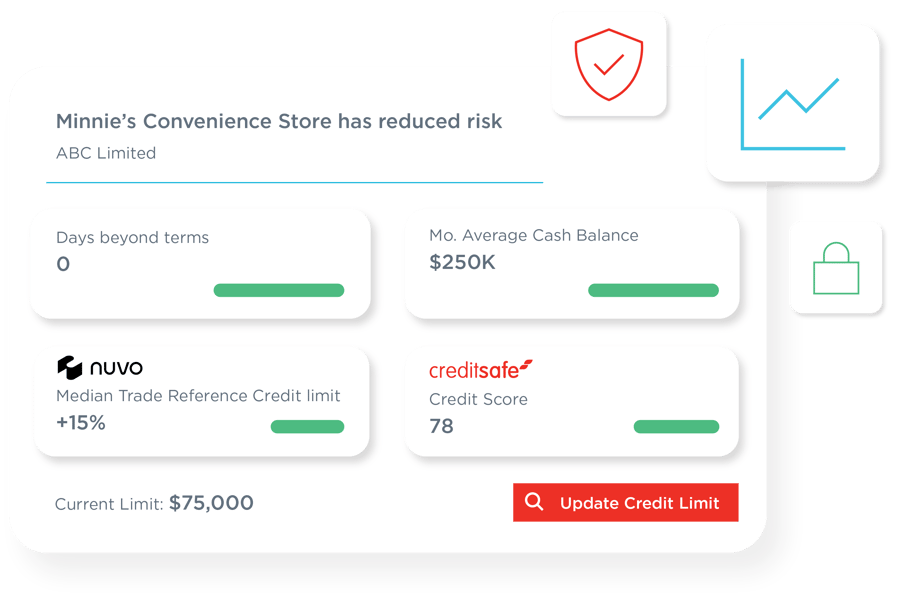

That’s why we’ve partnered with market-leading credit application providers like Nuvo to help you:

- Approve and onboard your customers quickly

- Get instant access to Creditsafe business credit reports

- Get real-time trade references from banks

- Verify that every business you work with is legitimate

- Minimize your risk of fraud