The Business Failure Risk Score model is based upon the observed characteristics of more than two million businesses in the Equifax commercial database and the relationship these characteristics have to the probability of a company experiencing failure over a period of 12 months.

A business is considered to have failed if it:

- Legally becomes bankrupt or is in assignment or receivership with unpaid debt or

- Ceases to operate without paying its creditors even if no legal notice is issued

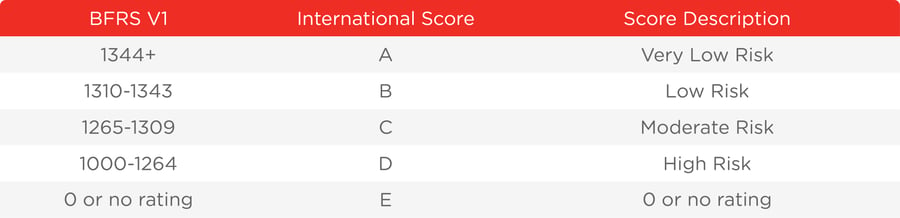

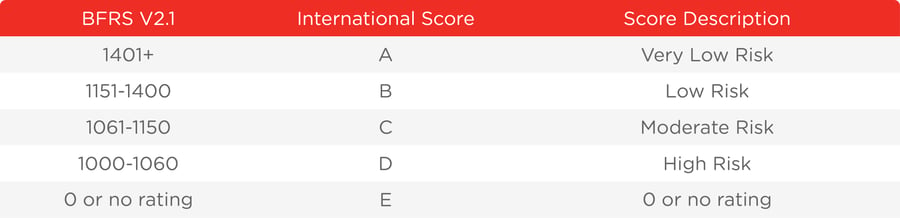

The Business Failure Risk Scoring model assigns a scale of risk from 1,001 to 1,650, where a score of 1,001 represents businesses that have the highest probability of failure. Meanwhile, a score of 1,650 represents businesses with the lowest probability of failure. This number provides a direct relationship between the score and the level of risk.

Sample data elements used in the model include:

- Small business banking trade payment performance

- Industry trade payment performance

- Public record data (suits, liens, or judgments)

- Inquiry data

- Firmographic data