Credit checks are part and parcel of life these days. In our personal lives, we can’t do much without them. We need them to get approved for credit cards, loans and mortgages. They’re just as important in the business world as they are in our personal lives.

But both people and businesses can get upset when a company asks to run a credit check on them. It’s been known to evoke a lot of emotions and make people feel antsy. I get it. But businesses can’t be so finicky – they need to rise above it. So, if your credit team tells you that you need to run a credit check on the business before they can even be considered a viable prospect and your prospect gets defensive, that’s a red flag you don’t want to ignore.

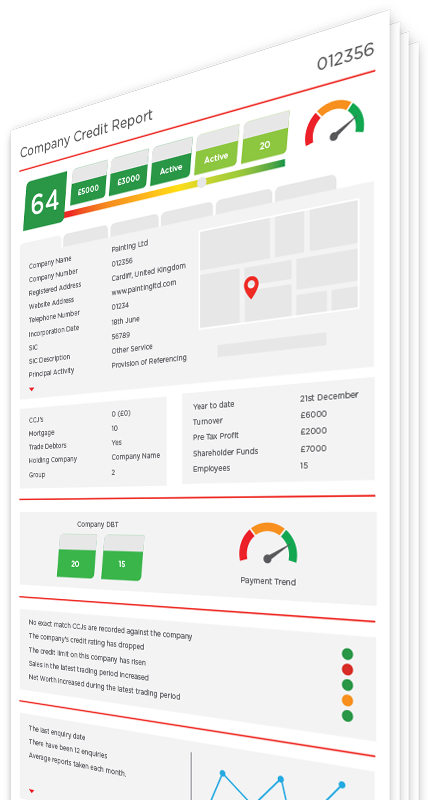

If a prospect feels uncomfortable about you running a credit check on their business, it could be a sign that their credit report will uncover several issues, including frequent late payments, a low credit limit, court judgments, bankruptcies or even compliance violations. Now, if you review their business credit report and all looks to be in good shape, then they might have just been uncomfortable with it.

But if you run the credit check and uncover any of the aforementioned issues, then that’s your sign to alert your credit control team immediately. Make sure they have visibility into their business credit report and ask them for their guidance. They might be willing to accept the prospect as a deal but will add specific clauses in the contract to protect your business. But you might also find that your credit control team won’t be so flexible and will tell you that this prospect simply won’t get approved. So, it’s better you don’t waste your time on a prospect that’s just not going to convert into a sales deal.