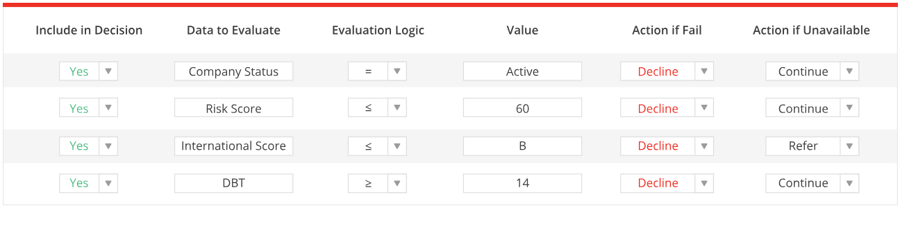

I wanted to drill into key factors that influence a credit decision, so I asked Bill James, Creditsafe’s Enterprise Sales Director, for his perspective. We started with high credit scores and credit limits.

Bill said, “Credit scores and credit limits are the two most common data points that businesses will look at when vetting potential customers. And often there’s a lack of insight into a company’s financials, especially if they’re privately held.”

To put this into the context of how a high credit score and credit limit could help a company get easily approved for credit, let’s look at these two data points in more detail.

- Credit score: When you look at a business credit report, you’ll see an international credit score, which is typically signified by a letter grade (A-E). A company that has its finances in good standing, has a good track record of paying invoices on time and has a low debt to revenue ratio is likely to have a higher credit score. So, if you see a company with an international credit score of A, that signals that it’s considered to be a very low risk and will increase its chances of getting approved for credit.

- Credit limit: Credit limit is often an indicator of how strong a company’s finances are and how much debt they’ve accumulated. Typically, if a company has a high credit limit (over $1 million), that’s a sign of good financial health. Of course, that figure will increase significantly based on a company’s size and annual turnover. So, you’d likely see publicly listed companies with a credit limit around $50 million.