Both sales and finance teams want to close more deals – just for different reasons. And when sales and finance operate on different risk signals, the result is easy to predict: deals fall apart at the last minute, mounting bad debt and unstable cash forecasts. To understand what’s driving this misalignment between sales and finance, we surveyed over 100 finance leaders and 115 sales leaders in the United States in November 2025.

This week, we launched our Breaking Risk Silos research study to shed light on this misalignment between sales and finance. Plus, the study explores why each team views credit risk so differently, lessons to be learned from past risky deals and much more.

Key research findings

- Deal rejections increased in 2025. Nearly half (49%) of sales leaders reported an increase in deal rejections in 2025, compared to the previous year.

- When credit scores drop, sales and finance don’t see the same storm. Nearly half (48%) of sales leaders said their teams are very likely to pursue a deal with a company that has a low credit score. Yet, 41% of finance leaders said their teams are very likely to reject a sales deal for that exact reason.

- Risky deals unite sales and finance – in regret. Nearly three-quarters (71%) of finance leaders regretted approving risky deals in 2025, while 40% of sales leaders regretted asking finance to approve risky deals.

- Shared credit risk data: Fewer surprises, fewer apologies. In fact, 61% of finance leaders and 77% of sales leaders believe fewer deals would be rejected if the sales team had access to credit risk data directly within their CRM platform.

Our research makes one thing very clear: when sales and finance aren’t on the same page, the cost goes beyond individual, one-off deal rejections. Instead:

- Sales and finance teams are misaligned when it comes to risk visibility

- Last-minute deal breakdowns become more common

- Bad debt exposure has the potential to increase

- Cash flow forecasts become less reliable and more difficult to determine

It’s no secret that we’re living through a challenging time economically. And for your business, that means credit risk needs to become everybody’s responsibility. When reliable, accurate credit risk data is part of your sales cycle from the beginning, your teams are better positioned to protect working capital, reduce friction and improve forecast confidence.

What does a risky deal look like?

Before we jump into the impacts of risky deals, let’s first define key indicators of risky deals. Risky deals typically display some or many of the following financial red flags:

Be on the lookout for:

- Average Days Beyond Terms (DBT) exceed a certain number of days, increase significantly, or repeatedly spike and dip over a 12-month period

- Business credit scores drop significantly

- Risk score of High or Very High

- Patterns of chronic late payments

- Worsening payment trends in recent months

- Active bankruptcy proceedings

- Listed on OFAC lists

- Credit limit exceeds a designated percentage of annual revenue

How to spot risky deals early

One of the biggest takeaways from Creditsafe’s Breaking Risk Silos research study is how problematic it is when sales and finance teams work from different data in their respective lead qualification and deal approval processes. What ends up happening is that sales teams spend unnecessary time pursuing deals with low business credit scores and high late payment rates. And then, those deals end up being rejected by the finance team in the 11th hour due to the high risk of late payments and cash flow strain.

“When sales and finance operate from different risk data, both sides lose,” explains Steve Carpenter, Chief Operating Officer for North America at Creditsafe. “As economic uncertainty and late payments increase for businesses, misalignment between sales and finance teams can lead to higher bad debt, lost revenue, damaged customer relationships and strained cash flow. Sharing credit risk data earlier in the sales process is the fastest way to reduce regret, deal friction and cash flow strain.”

Steve is absolutely right. So, the question is now: What types of data should you be looking at to spot risky deals early? I’ll tell you.

Business Credit Score: This metric, also called a risk score, tells you how likely a company is to declare bankruptcy in the next 12 months. A good business credit report provider will use a universal business credit score system, so you’re always comparing like to like.

Days Beyond Terms (DBT): How many days, on average, a company pays their bills past due. A rising or fluctuating DBT can signal cash flow issues and a potentially riskier deal.

Aging Invoices: These figures show how many invoices the business has outstanding and how late they are. An invoice may be listed as:

- 1-30 days past due

- 31-60 days past due

- 61-90 days past due

- 90+ days past due

Credit Usage: How much credit the business is currently being extended. An overreliance on credit could point to mounting debt and snowballing issues that could become an issue down the road.

Legal Filings: Filings like bankruptcies, liens, judgements and other court documents give you insight into how the business is performing and whether they’ve ever run into legal trouble before.

OFAC Listings: A company with ties to an OFAC (Office of Foreign Assets Control) listed entity should be an automatic no-go. It means that the business works with a person or business that’s been identified as “targeted actor.” US businesses are prohibited from doing businesses with entities with OFAC listings.

Shared credit risk data: the best way to reduce deal regret

Our study found that over half (61%) of finance leaders and over three-quarters (77%) of sales leaders believe fewer deals would be rejected if the sales team had access to credit risk data directly within their CRM platform. Both sides agreeing about something? Isn’t that great to hear? We certainly think so.

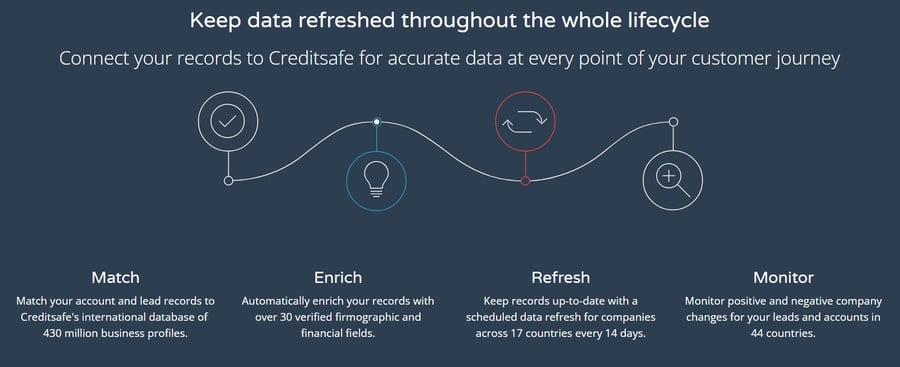

Now, it’s just about figuring out the best method to share credit risk data between the two teams. One method is to use a single-source API that connects to all your workflows and apps.

Now, if your sales team already uses Salesforce as its chosen CRM platform, then you could also use the Business Intelligence Plus App for Salesforce. This will allow your sales team to pre-qualify leads based on their affordability, speed up and improve account target planning as well as make it easy to quickly refresh and update account data.

It’s hard to deny the power of shared credit risk data, especially when finance leaders and sales leaders both agree that it would help reduce deal rejection rates. That’s the ultimate goal, isn’t it?

Why Creditsafe’s research matters

- Your company can reduce overall risk exposure and cash flow strain by making sure sales and finance are working from the same credit risk data.

- Your company can collect payments faster and reduce your Days Sales Outstanding (DSO).

- Your company can position itself for long-term revenue growth by avoiding customers with a low business credit score and high late payment rate.

Improve forecast confidence with shared credit risk visibility

Let's talk about how you can integrate Creditsafe data.

About the Author

Yesinne Alvarez, Partnerships and Alliances, Creditsafe

Yesinne Alvarez is Manager of Partnerships and Alliances at Creditsafe and supports the Trade Data Team with deep cross-functional expertise. With extensive experience in Relationship Management, Project Management, and Business Development, Yesinne brings both authority and trust to her role. Her background includes senior roles in recruiting and strategic development for Fortune 100 companies. A recognized expert and respected thought leader in the Credit to Cash community, Yesinne has frequently spoken at industry events and served in leadership roles, reinforcing her trusted status in the credit and finance space.