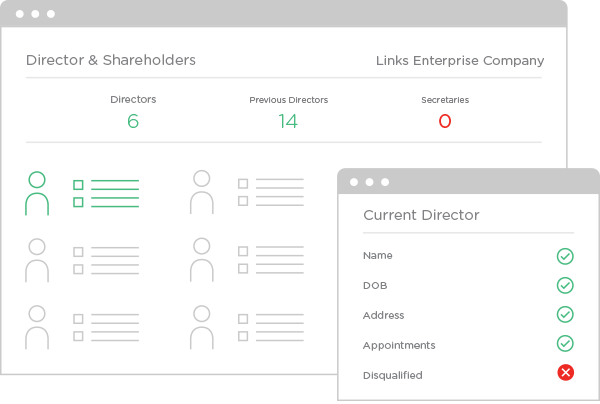

Our credit scorecards are one of the most predictive scorecards in the industry, approved by the leading credit insurers. Our leading credit scoring system includes key statistics and the most advanced statistical techniques to help determine the financial stability of a company.

With this credit scoring model, we succeed in predicting 81% of bankruptcies 12 months before the company becomes insolvent in Belgium and 70% for international companies.

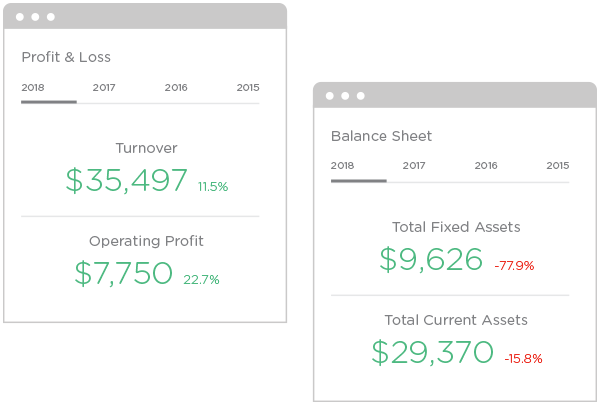

Take well-informed business decisions with the help of our reliable company financial data