Analyzing financial company data is the core of what we do at Creditsafe.

Creditsafe provides you with a complete and transparent access to your company's (credit) profile, giving you a better understanding of the factors that influence a company's credit score.

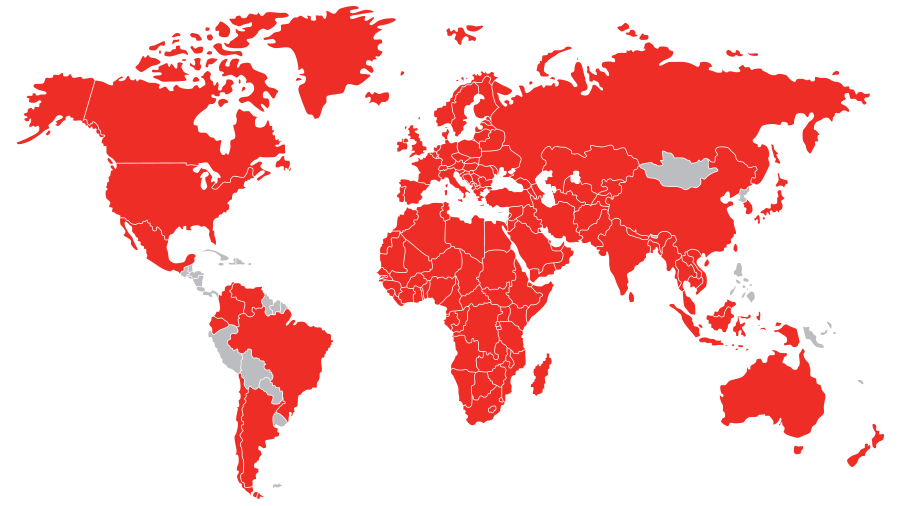

Our leading credit scoring model incorporates the most advanced statistical measures and techniques to help determine the financial stability and strength of a company. With this scoring model, we can predict 81% of bankruptcies in Belgium 12 months before the company becomes insolvent, and on an average of 70% for international companies.