COVID-19, supply chain disruption, scarcity of labour, raw materials and materials, rising costs of energy, raw materials and wages, inflation, accelerating green transition, an increase in bankruptcies and judicial dissolutions, roadworks, fire damage, floods, etc.

One thing all shocks have in common: they are often unpredictable and have a huge impact on the companies involved if they do not have reserves to fall back on. Do you know which of your customers are capable of absorbing such a shock?

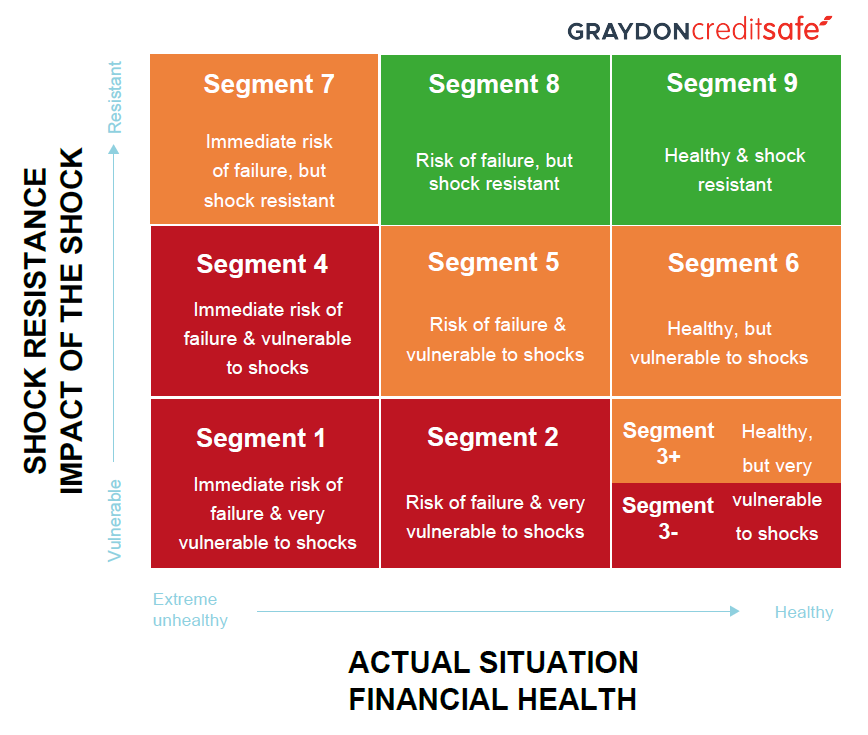

GraydonCreditsafe developed the Shock Resilience Score for this purpose. The score indicates the extent to which a company can withstand one or more shocks. It is a calculation of the reserves a company holds, in addition to those needed to cover normal operations and normally predictable risks.