Introduction

As humans, we make roughly 2,000 decisions per hour in both personal and professional settings - so it's no wonder that anybody could easily make an error and make the wrong decision that could have catastrophic consequences for the business (and their career). In choosing to automate decisions, companies safeguard themselves and their teams to ensure that the logic behind these decisions remains consistent and accurate.

What's more, in a world where time is the most valuable commodity to each individual, it's no wonder that businesses are turning to automation to help transfer their processes in order to make more time to complete additional tasks.

But what is automation, what types of businesses can benefit from it, and why is now the right time to transform existing processes?

What is automation?

Automation is typically when technology is employed to accomplish a single or series of repetitive tasks with a predetermined workflow to create output with little or no human assistance. Businesses across several industries utilise automation, including financial, manufacturing and telecoms.

What are the benefits of automated decisions?

The primary benefit of automation is the removal of the human element. When individuals make decisions, a whole host of different factors need evaluation before any confirmation that the decision is accurate. For example, the individual could be experiencing a bad day or be distracted, which in day-to-day circumstances have limited consequences. However, when making business decisions, these circumstances can lead to inaccurate decision-making that can have long-term financial, legal or reputational implications.

-

Time & Money

By automating business decisions, a company can benefit from the time saved by eliminating human considerations and, in many cases, eliminate roles within the company which can save them funds they can reallocate elsewhere.

-

Quality & Accuracy

By harnessing the power of automation, decisions are made by inputting various high-quality external data sources that can provide insights to make a confident decision. For example, a credit score on a company can be used in the first instance to detect whether or not another company should do business with them.

What is a decision tree?

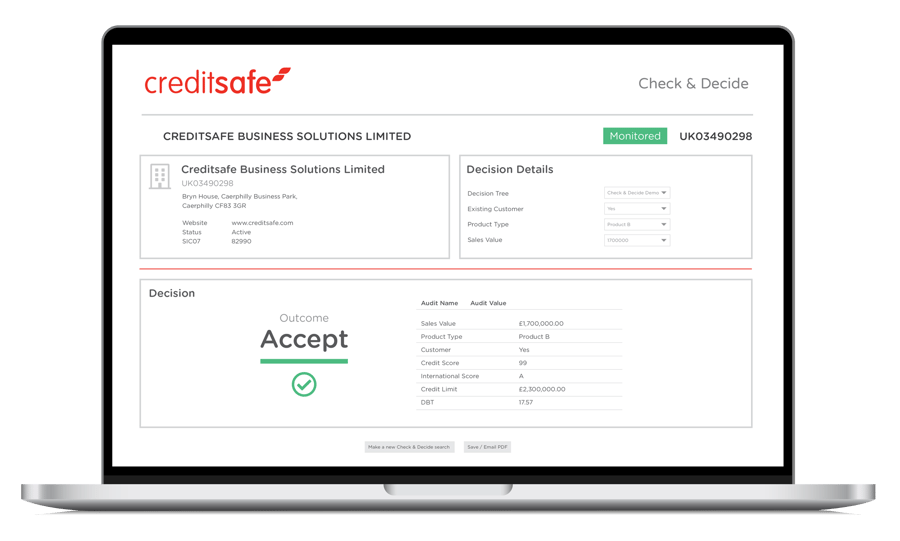

A decision tree is a visual representation of the stages of questions that need answering in order to make a decision. In its simplified form, the answer to each question will determine whether the final result is a pass or a fail.

What departments within a business can benefit from automated decisions?

Automated decisions can benefit countless departments within a business. By using Creditsafe's Check & Decide, a marketing department could benefit from lead qualification to help eradicate low-quality leads and enable the high-quality leads to be passed to the sales team member.

Onboarding teams can speedily welcome new customers accurately, ensuring all the correct checks have been completed and passed before the final decision.

In a credit control setting, automated decisions can highlight those who would be high risk and encourage further manual investigation into whether the company or individual is suitable.

What data is available from Creditsafe to automate a decision?

-

Over 200 Creditsafe data fields are available

-

One of the industry's most predictive scores

-

Bank verification, KYC & AML data

-

CCDS Data

-

UK Consumer Data

-

Include an unlimited number of own data fields

Is there an off-the-shelf solution for automating decisions?

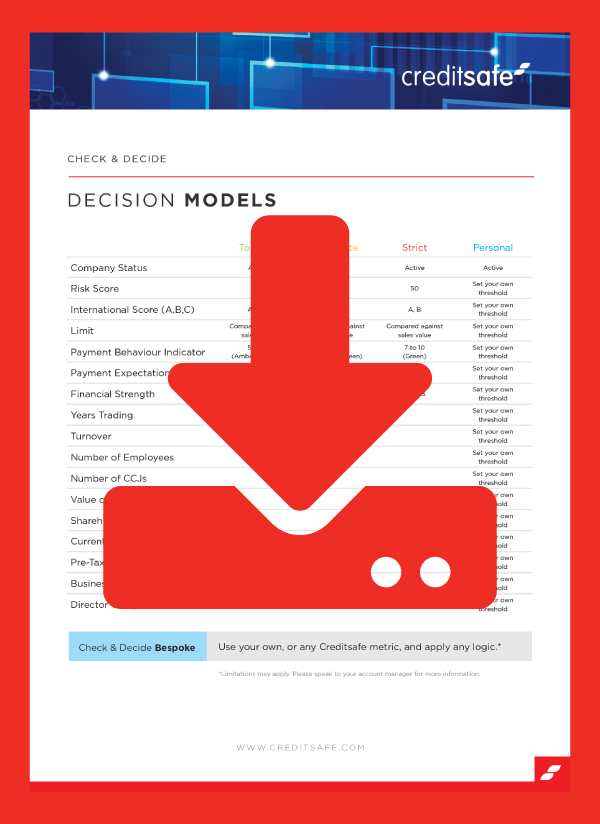

Yes. Creditsafe offer Check & Decide Decision Models, which allow the user to take a pre-made decision template and customise the logic to achieve the intended outcome. Each decision model is different and is either 'Tolerant', 'Moderate', or 'Strict', depending on the policy. See the Decision Model Parameters PDF below.

If none of these suits the client's needs, Check & Decide's bread and butter is custom policies, so we can create a bespoke decision engine to generate a solution.