Consumer Credit Reports

Check the financial health of individual consumers to reduce personal lending risk.

Learn more →Trading in global markets means dealing with different regulations, transparency levels and financial reporting standards. International credit reports give you the reliable insight you need to verify overseas companies, understand their financial health and reduce international credit risk.

Verify International Companies

Instantly confirm a company’s registered details, legal status, and trading identity anywhere in the world. Reduce the risk of dealing with unverified or fraudulent overseas businesses.

Understand Global Payment Behaviour

See how a company pays its suppliers internationally with Days Beyond Terms and payment trend data. Spot late payers before they impact your cashflow.

See Global Ownership & Group Structure

Understand who actually owns the business. All international reports include corporate linkage, UBO details, and group structure to help you assess global exposure.

Reduce International Credit Risk

Assess a company’s financial strength with global credit scores and recommended limits. Ensure you’re only trading with overseas partners who can meet their credit commitments.

Access Country-Specific Credit Insights

Every country has different reporting standards, Creditsafe standardises the data for you. Get clear, comparable insights no matter where the company is based.

Cross-Border Compliance & Due Diligence

Identify compliance risks with international screening checks included as standard. Quickly spot sanctions, PEPs, adverse media, and other red flags when trading abroad.

Get a clear picture of a company’s creditworthiness in seconds. Our Risk Score (0–100) predicts the likelihood of insolvency within 12 months, while the International Score (A–E) allows for easy comparison across countries. Recommended Credit Limits and Contract Limits help you set safe trading terms based on financial data and payment history.

Keeping track of overseas customers and suppliers is essential, especially when trading across different markets and time zones. Creditsafe’s International Monitoring service sends you real-time email alerts whenever a company’s financial position, credit score or legal status changes.

Monitor companies across 48+ countries and respond to risks before it affect your business.

Select a country below to find out more. If you need insight into a specific country, we can provide sample reports.

Creditsafe offer a truly global risk management solution featuring company data and analytics from businesses around the world. We’ve built the world’s largest owned database of more than 430 million business reports across 200 countries. Instantly tap into our database to assist fast and data-driven decisions, helping you grow your international business with peace of mind.

Almost all reports requested will be delivered instantly online, and for any others we'll provide you with a freshly investigated company report.

Over 430m credit reports available instantly online

A – E International credit score for easy comparison

99.9% of requested reports delivered instantly

To make things easier for you when trading internationally, we have created an international score. This allows you to compare company credit scores across the globe and will provide you with peace of mind, regardless of which country you are trading in. By using the same scoring range and risk descriptions for all countries, we make it even easier for you to compare reports.

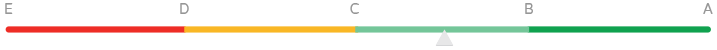

Our score is designed with simplicity, ranging from A-E; A being the lowest risk, D being the highest risk and E being unrated. It measures the likelihood of a company becoming insolvent within the next 12 months.

Creditsafe helps you avoid bad debt and reduce risk by giving you instant access to company credit scores, limits, and warning signs. Spot slow payers, monitor financial stability, and make confident credit decisions before you commit.

An international company credit report provides a detailed assessment of a business registered outside your home country. It includes verified company information, financial data, global credit scores, payment behaviour, ownership, and legal filings, all standardised into one easy-to-read format. This helps you evaluate the creditworthiness and financial stability of overseas customers, suppliers and partners.

You can learn more about what’s included in our reports on our International Credit Reports and Business Credit Reports pages.

Creditsafe provides access to credit information on companies in over 200 countries and territories, one of the broadest coverage networks available. This includes Europe, North America, South America, Asia-Pacific, the Middle East and Africa.

You can view our full list of countries and data availability in our International capabilities and coverage guide.

When a company report is not available to view online, you have the opportunity to freshly investigate a business. Once this request is received, we will attempt to contact the company directly through our network of local partners and official registries to provide a detailed report within 2–10 working days.

You can view our full list of countries and data availability in our International capabilities and coverage guide.

Most international credit reports are available instantly, thanks to Creditsafe’s fully owned global database and direct connections to official registries. In markets where data must be manually retrieved (such as certain emerging economies), reports are typically delivered within 24–72 hours.

You can view our full list of countries and data availability in our International capabilities and coverage guide.

Creditsafe's global company credit reports combine data from multiple trusted sources, including:

You can view our full list of countries and data availability in our International capabilities and coverage guide.

Creditsafe’s international credit reports are updated in real time, with over one million data updates processed every day across our global database. This ensures you always have the most accurate, up-to-date information available when assessing overseas companies.

You can view our full list of countries and data availability in our International capabilities and coverage guide.