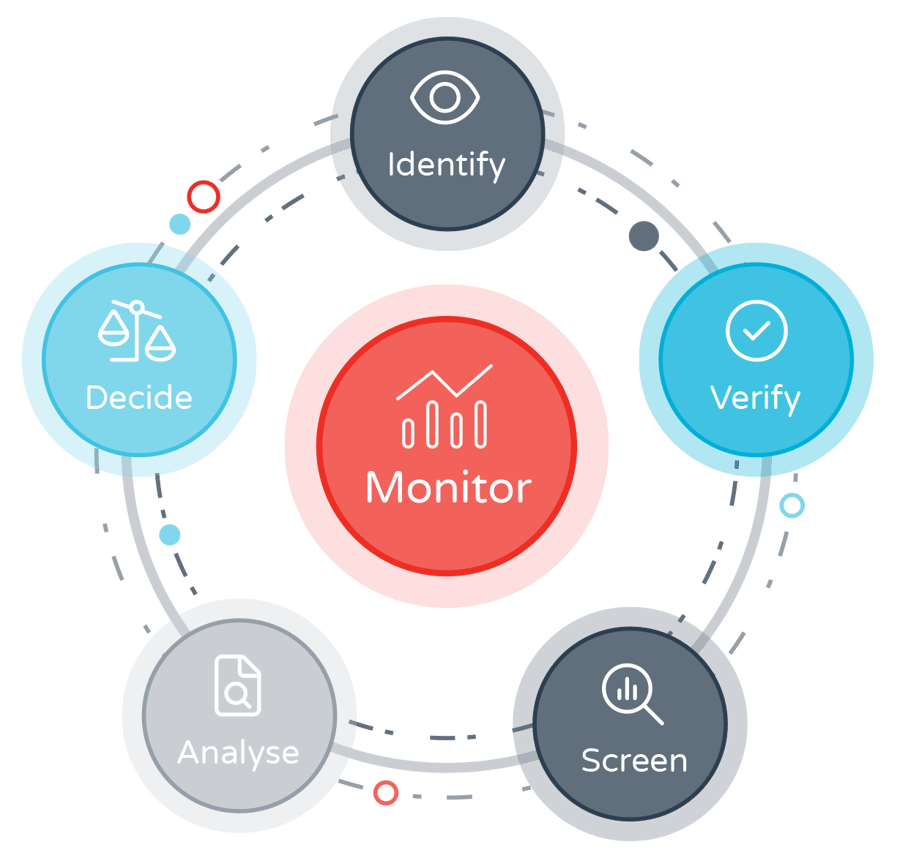

KYC Protect empowers your business to centralise all your due diligence processes and removes the need to move between multiple systems to safeguard against legal, financial and reputational risk

Identify and verify key controllers in seconds

Leverage Creditsafe's in-depth and reliable business data to find the correct entities and ensure your KYC data is accurate and up-to-date.

-

30,000+ data sources

-

Over 4.8 million profiles

-

200,000+ updates per month

-

Covering 200 countries & territories

We’ve been really impressed with Creditsafe and KYC Protect. It’s made a big difference in helping us meet our compliance requirements and has given us much more confidence in how we handle customer checks and due diligence. I’d happily recommend Creditsafe and the KYC Protect Compliance product to any business that wants a reliable, supportive solution for regulatory screening and customer verification.

Rebecca Scaife

Senior Paraplanner & Client Services Lead

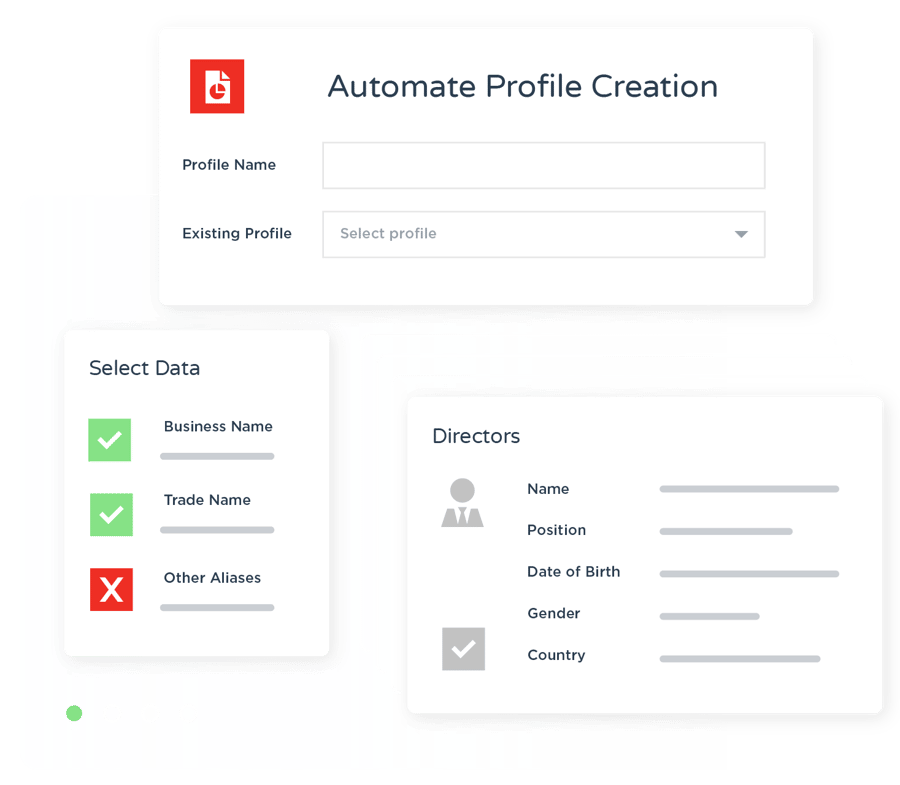

Improve customer experience with streamlined onboarding

Build trusted relationships with new customers and business partners

When customers expect instant onboarding, slow procedures can impact your brand perception and bottom line. KYC Protect transforms your onboarding process into a strength rather than a hindrance, allowing you to welcome new customers and suppliers without the frustrating delays of lengthy processes.

-

Complete a risk assessment in as few as 3 clicks

-

Dramatically speed up screening time with a single search

-

Build trusted business relationships with confidence

Batch upload names of individuals and businesses and screen up to 50,000 records in a single check.

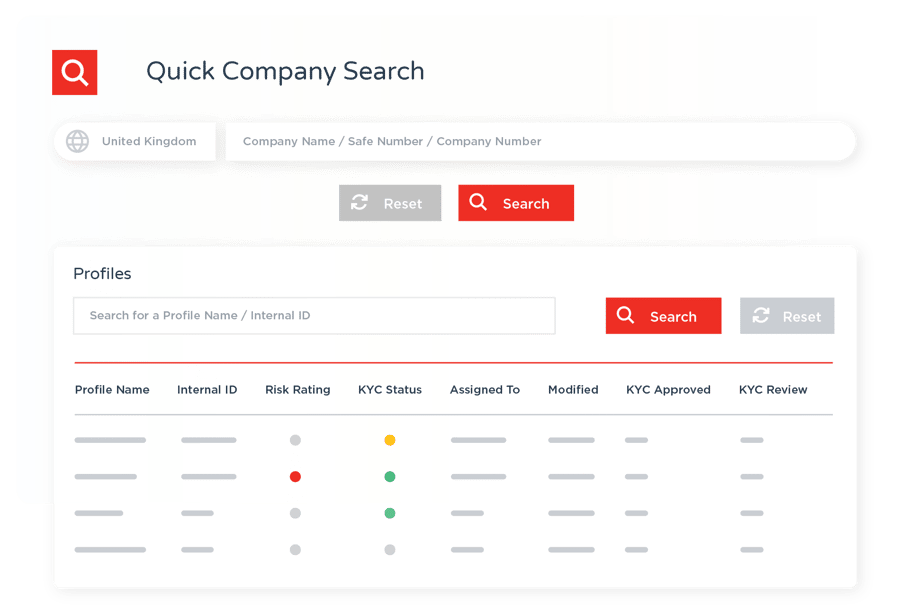

Focus on genuine risks

Experience an average of 50% fewer false positives so that time and resources are allocated to identifying and mitigating actual threats to your business.

Screen against all major risk categories to protect your business from legal, financial and reputational threats. You can filter by Sanction type and PEP tier for even more precise risk assessment.

-

Sanctions

-

Enforcement

-

PEPs

-

Adverse Media

-

State Owned Enterprise

-

Profile of Interest

-

Disqualified Director (UK Only)

-

Insolvency Register (UK Only)

Integrate KYC Protect with your existing systems or access our web based platform

Choose how you access KYC Protect

-

Website

Access KYC Protect online via our intuitive and user-friendly Accelerator platform. The user interface is designed so you can seamlessly move from our company reports to KYC Protect.

-

KYC Protect API

Integrate KYC Protect with your in-house systems to create continuity between due diligence and your existing business operations.

-

User Freedom and Flexibility

No restrictions on the number of users you have, just sign up and start benefiting from KYC Protect right away.

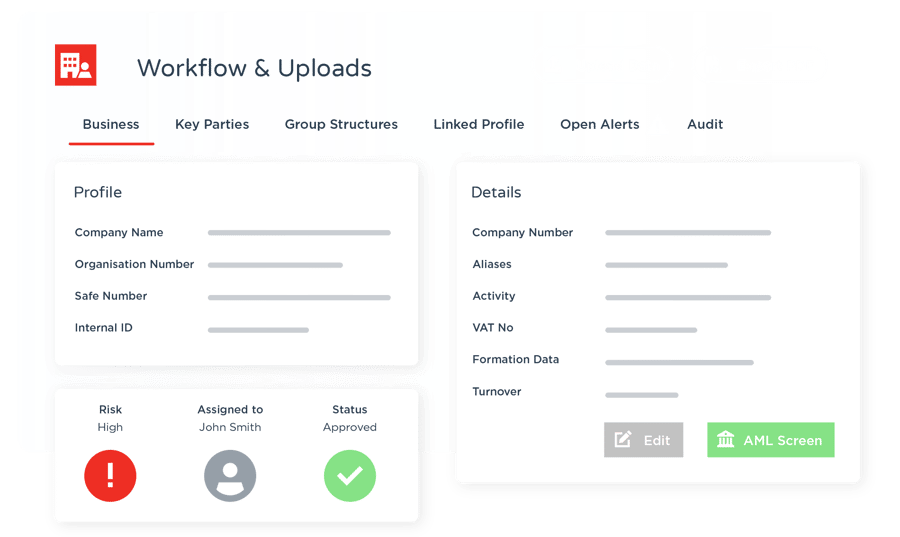

Make clear-cut decisions about who you should do business with

Get a clear overview of profiles to highlight high-priority, incomplete and in-review workloads.

Track case status and collaborate with colleagues to ensure a smooth transition from search to decision in just a few clicks. Create clean and consistent risk management processes and reduce the likelihood of human error.

-

Frictionless workflows enable you to assign cases for review or approval.

-

Upload documents to consolidate all relevant data within KYC Protect.

-

Retrieve a record of all actions taken on a profile with a full digital audit trail.