Check & Decide uses templates that are built using metrics and rules that represent industry best practices. There's no coding required, and templates are fast and easy for you to set up. Each Check & Decide template can be configured and changed according to your business needs.

Trusted by the world's most innovative companies...

Automate business decisions using templates built with best practice credit and compliance metrics

Check & Decide reduces operational costs and errors creating immediate efficiencies across your business.

-

Close sales deals faster

Check your next prospect before engaging with them and close sales opportunities faster without a long-winded approval process.

-

Consistent business decisions

Standardise your checks so that every decision aligns with your policy and eliminates the risk of human error and biases.

-

Easy customer onboarding

Onboarding becomes your competitive advantage. Your customers are happy, and you have a shorter time to revenue.

-

Frictionless policy changes

Make changes to your policy template as your business needs evolve without disrupting the decision-automation process.

-

Decentralise decision-making

Reduce the strain on your credit team so that any authorised employee can make precise decisions with confidence.

-

Transparent record of decisions

Analyse how decisions are impacting your business and get full visibility of who made a decision and when it was made.

Lightning fast decisions powered by data for over 430 million companies in 200 countries

Optimise risk assessment and have confidence in decision automation that's backed by world-leading data.

Why choose Creditsafe data for decision automation?

- Standardised rules applied to Creditsafe's credit, risk, and payment information

- Access real-time data on over 430 million companies

- Automate decisions on businesses in over 200 countries

- Trusted data from local and official sources

- A credit score that is the most predictive in the industry

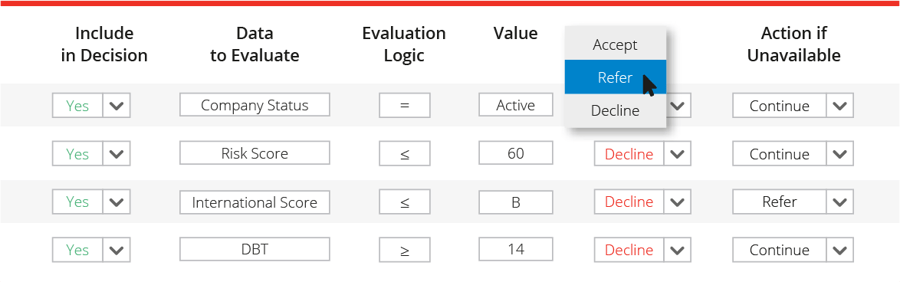

Your no-code decision automation solution

-

Select the checks you want to include or exclude in your template.

-

Select the threshold values for each of the checks.

-

The threshold value determines if a check is accepted, declined or referred.

-

Modify the rules and logic of your template and implement changes in minutes.

Choose how you access Check & Decide:

-

Website

Access Check & Decide online via our intuitive and user-friendly platform and start making decisions in just a few clicks.

-

Connect API

Integrate Check & Decide with your existing CRM or ERP system to see the power of making important business decisions in seconds.

-

Salesforce

Your teams can run checks directly in Salesforce so that you are getting even more value from your subscription.

Consistent and smart decisions for every business

Moving away from manual checks on consumers, suppliers and partners reduces the likelihood of errors occuring that could expose your business to greater risk. Automate credit and lending decisions to confidently onboard customers with certainty, all in under 60 seconds.

-

Banking and lending

Creditsafe supports lenders and challenger banks by automating end-to-end lending processes. Business, consumer and identity data can power real-time decisions in under a second, delivering fast approvals and unforgettable customer experiences.

-

Digital onboarding

Customers demand a frictionless onboarding process, but ever-changing compliance regulations and evolving fraud risks threaten to slow you down. Creditsafe’s risk decisioning platform simplifies your ability to create, adjust and implement risk processes - powering fully automated onboarding.

-

Retail and point-of-sale

As a retailer, you need the right data to make accurate lending decisions quickly. Creditsafe provides one-click, real-time decision engine functionalities that power more accurate credit decisions.

-

Auto leasing and financing

As an auto lender, you need smooth loan approvals that quickly move cars off the lot. Creditsafe lets you deploy sophisticated risk models to make the right decisions in seconds without relying on external vendors or development teams.