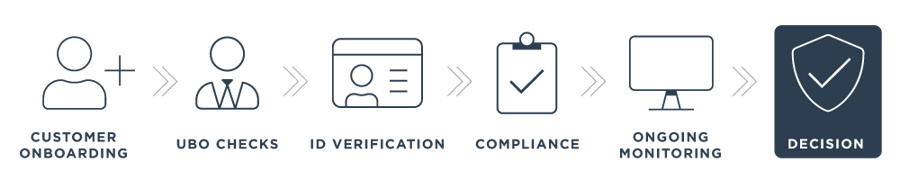

Know Your Business (KYB) checks allows a business to check that they are working with other legitimate businesses. When running a KYB check, you can identify the validity of a business by checking addresses, running Ultimate Beneficial Owners (UBO) checks, along with Anti-Money laundering (AML) checks. Using Creditsafe, you can access our global business data with information on more than 365 million businesses around the world, including director information and shareholder information.

KYB ties in with current AML laws and regulations, including the most recent 6th Anti-Money Laundering directive (6AMLD).