In 2024 alone, cases reached a record high of 421,000, costing UK businesses £1.17 billion. That equates to nearly £2,230 every minute.

Invoice fraud is one of the most common types of fraud in the UK, and the emerging trend of AI generated invoices isn’t making this any easier to combat. Forging invoices was something that previously took hours. Now, with generative AI, it takes just seconds. The Rise in AP Fraud report discovered that 62% of organisations felt generative AI was the primary contributor to the increase of fraud.

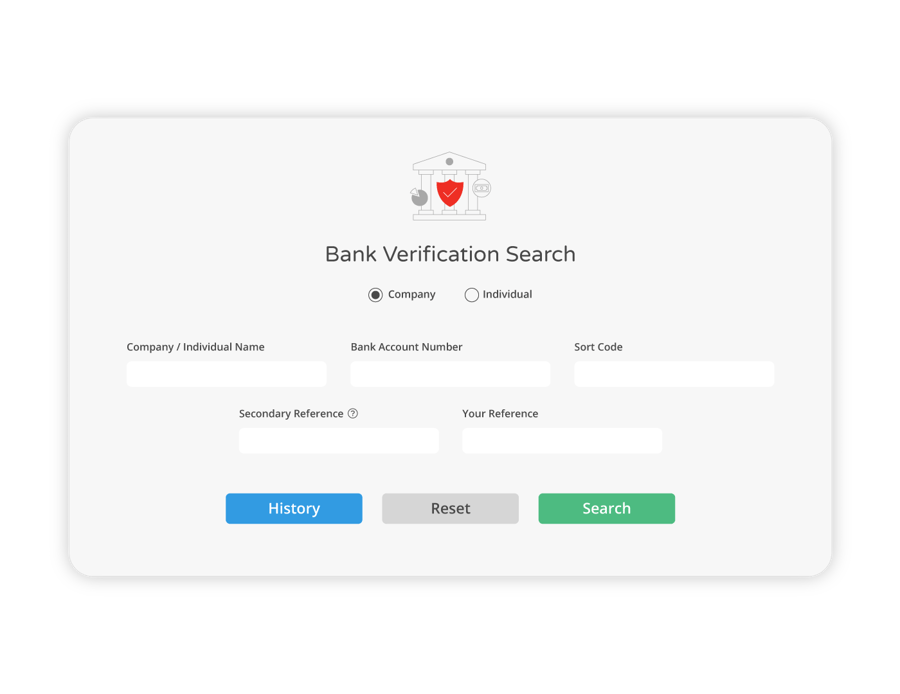

As a result, data validation is more important than ever. That’s where bank account verification comes in.