Creditsafe has teamed-up with supply chain experts, Eddie Stobart, and together have built the 6 key steps to improve your supply chain management. See if you can find a way to improve your supply chain process below:

The importance of monitoring customers and suppliers

Creditsafe customers monitor 8 million companies, and were alerted on 28 million occasions about potential threats and changes last year.

Can you always tell when a supplier is being honest? Being caught out by a dishonest supplier can effect any business, but what if you could avoid this altogether? More than 100,000 Creditsafe customers are monitoring their customers and suppliers, helping build a good supply chain.

It's no secret that most businesses struggled during Covid, and being able to keep an eye on customers and suppliers is a necessity to ensure you protect your own business from any unexpected changes.

Creditsafe monitoring is automatically integrated into our business credit reports, so with a click of a button, you can add a company to a monitoring list, and start receiving alerts on company changes instantly.

Put simply, supply chain is an essential activity for most businesses, where a company and supplier work together to distribute their products and goods in the most efficient way possible.

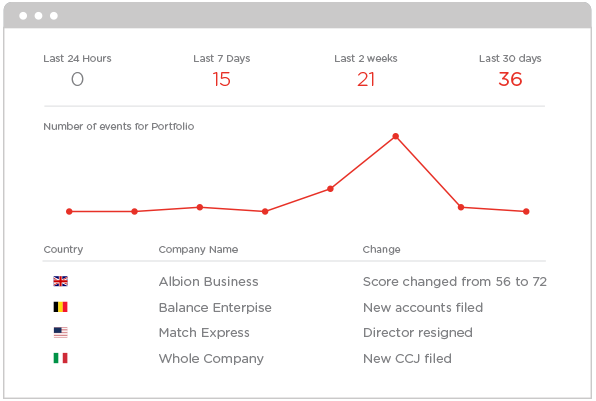

*Example monitoring report

How to monitor your customers and suppliers with the Creditsafe system

By default, we automatically add a customer or supplier to your monitoring list. If you would like to switch auto-monitoring off, simply search for a company, and click the 'monitor' button in the top corner to add to your list.

From there, you can create bespoke portfolios so you can monitor suppliers, customers, and even competitors in separate lists to make it easier for the user.

When a company is added to any of your chosen lists, you will receive instant email notifications when changes are made to a business.

Why do our customers rely on Creditsafe monitoring?

Creditsafe provide customers access to 365 million companies, with monitoring available in 44 countries (with more added soon). Uploading a portfolio list makes it easier for you to monitor both existing and new suppliers and customers.

When there are changes to a company's credit report, you will be notified via email as soon as it happens. The changes you wish to see are completely bespoke to you, and you can choose the key changes you feel are relevant to your business.

Alerts to changes such as company credit score, credit limits, company name changes, and any key financial changes help ensure our customers can act when it matters the most.

Wendy James at Scania say's “As part of our compliance obligations we have to monitor changes and react accordingly. Creditsafe’s monitoring system helps with this and the best part is, unlike previous providers, the alerts do not all come to me. Each credit controller has their own portfolio and their colleagues can have access at any time to ensure cover during holidays so no alert is missed”.

-

Monitor changes to companies in 44 countries

Get real-time monitoring alerts on UK and international companies, when you deal with suppliers on an international scale.

-

Competitor Alerts

Add your competitors to a portfolio and receive updates on changes to their company credit reports as and when they happen.

-

View key company changes in the way you want to

Explore individual portfolios in your dashboard over a timefame that you select

-

Unlimited Monitoring

At Creditsafe, our customers can monitor a unlimited amount* of customers at any one time.

-

Supplier Analysis

Analyse your entire portfolio, allowing you to compare customers in different segments so you can identify where your biggest risk lies.

*According to fair usage