Fast, Reliable Risk Scores

Our 0–100 insolvency risk score updates daily to reflect the latest changes in a company’s status.

Get a clear picture of a company’s creditworthiness in seconds. Our Risk Score (0–100) predicts the likelihood of insolvency within 12 months, while the International Score (A–E) allows for easy comparison across countries. Recommended Credit Limits and Contract Limits help you set safe trading terms based on financial data and payment history.

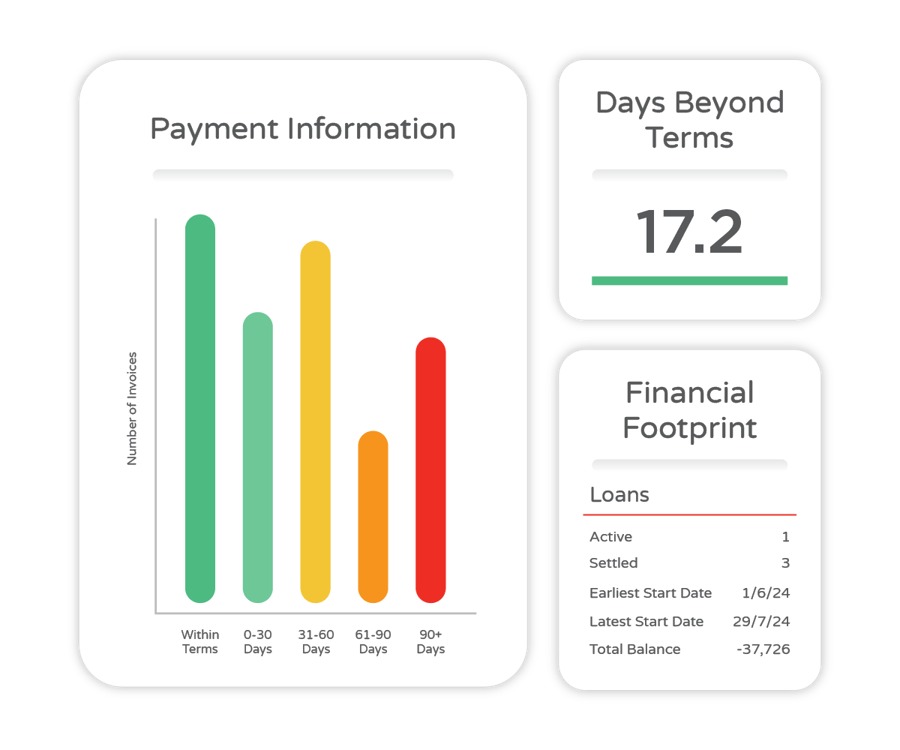

Get a complete picture of how businesses manage their obligations by combining supplier payment trends with commercial banking data. Track invoice payments and Days Beyond Terms (DBT) to identify slow payers, while monthly updates from major banks provide insights into loan and overdraft usage, cash balances, and repayment performance. Together, these insights reveal how companies really pay, helping you assess cash flow risk, lending exposure, and affordability with confidence.

Our reports include County Court Judgments (CCJs) updated daily from official court sources, as well as writs, profit warnings, and HMRC’s deliberate tax defaulters list. We also flag HM Court Notices such as insolvency petitions. Creditsafe Exceptions highlight irregular activity — like multiple CCJs, frequent director changes, or enquiry spikes — as early signs of trouble.

Identify directors (current and former), shareholders, Persons with Significant Control (PSC) and Ultimate Beneficial Owners (UBO) to understand ownership and influence. Then go further with Creditsafe Verify, which screens individuals against the electoral roll and flags if they have personal CCJs, are insolvent, or even deceased, helping you avoid fraudulent identities, disqualified directors, and hidden risks.

Creditsafe helps you avoid bad debt and reduce risk by giving you instant access to company credit scores, limits, and warning signs. Spot slow payers, monitor financial stability, and make confident credit decisions before you commit.

Our 0–100 insolvency risk score updates daily to reflect the latest changes in a company’s status.

Insights based on over 500 million invoices collected directly from our customer network.

Creditsafe Exceptions highlight irregular activity so you can act before issues appear in the financials.

Compare companies worldwide with our standardised A–E International Score.

A company credit report is a detailed summary of a business’s financial health and creditworthiness. It typically includes information such as payment history, outstanding debts, legal filings (like CCJs), company structure, credit score and a recommended credit limit. Lenders, suppliers, and potential partners use these reports to assess risk before entering into financial agreements.

A company’s credit score is influenced by several key factors:

Maintaining timely payments and a healthy balance sheet are essential for maintaining a strong credit score and report.

Creditsafe company credit reports are updated daily to reflect the most current financial data, payment activity, and legal filings. Creditsafe continuously monitors changes such as new accounts, CCJs, or director updates, ensuring you always have access to the latest risk information when making business decisions.

You can check a business credit score by using a commercial credit reporting service like Creditsafe. Simply search for the company name or registration number, and you’ll receive a report showing its credit score, financial data, and risk indicators. These scores are updated regularly and reflect how likely a business is to meet its financial obligations.

Checking a company’s credit score and report helps you assess its financial stability and payment behaviour before entering into contracts or extending credit. A poor score may indicate late payments, financial distress, or risk of default, while a strong score suggests reliability and low risk. It’s a vital step in protecting your cash flow and avoiding bad debt.

Yes, with Creditsafe, you can access a full company credit report completely free. Unlike other providers that offer limited data, our free report includes all the key details found in our paid reports, including:

This is the same comprehensive report trusted by financial institutions to assess business creditworthiness. To request your free company credit report, simply complete the form on this page.