Anti-Money Laundering Checks

Trusted by the world’s leading legal specialists...

-

Verify a client's ID immediately

Our AML checks screen against global PEP and Sanction databases to give you the highest protection against terrorism funding, fraud and other unlawful financial activity.

-

Paperless audit trial

There is no need for physical storage because, at Creditsafe, we store a paperless audit trail for five years in a highly secure environment to evidence your compliance whilst protecting your clients’ data.

-

Online PEPs & Sanction checks

Streamline your Politically Exposed Persons (PEPs) and Sanctions compliance with instant online checks, which screen against a multitude of global and domestic databases in one go.

Business Credit Reports

Access data from over 200 unique data points for more than 430 million companies.

-

99.9% of reports available online instantly

Access key company financial data and instantly evaluate financial stability of businesses via our online credit reports.

-

View reports in more than 200 countries and territories

Our international coverage allows you to access credit reports on businesses around the world.

-

Company credit scores and limits

See a company's credit score and maximum recommended credit limit.

-

Beneficial owners

Confirm the identity of directors and owners, and explore a company's group structure to support your KYC checks.

-

International monitoring

Set up customisable alerts and get notified any time there are any critical changes in global companies you work with in over 45 countries.

-

Delivered to suit your needs

Access our global business data through our powerful Connect API, Salesforce, integration apps, our website and more.

Verify

Make better-informed decisions by evaluating the individuals behind a business.

When you’re assessing individuals, sole traders, or directors, you need deeper insight to make informed decisions.

With just a name, date of birth, and address, you can instantly screen an individual for County Court Judgments (CCJs), insolvencies, mortality records, and verify their residency via the UK electoral roll.

Whether you’re dealing with a sole trader, a company director, or an individual customer, Verify gives you a full view of the person behind the business, or the individual in question.

KYC Protect

Unify KYC, AML screening and monitoring with one comprehensive solution.

-

Identify and verify key stakeholders in seconds

Establish who the directors, shareholders, and UBOs are in a business and automatically create profiles with their information using data from Creditsafe’s international company reports.

-

Focus on genuine risks

Experience an average of 50% fewer false positives, so that time and resources are allocated to identifying and mitigating actual threats to your business.

-

Make clear-cut decisions on who to do business with

Gain a clear overview of profiles, track case status and collaborate with colleagues to ensure a smooth transition from search to decision in just a few clicks.

-

Monitor changes to risk status as they happen

Receive emails and in-product notifications when a change occurs to a KYC or AML case that impacts the risk status of a company so that you can take immediate action.

ID Verification Plus

Confirm the identity of individuals, reduce fraud and ensure regulatory compliance.

With Creditsafe’s ID Verification Plus (IDV+), you can quickly, easily and securely meet your regulation and compliance needs around Know Your Customer (KYC), Anti-Money Laundering (AML) and Age Verification.

Using cutting-edge biometric facial recognition technology, ID Verification Plus confirms the authenticity of an identity document, providing you with real-time results you can trust. Our software can extract data from official ID documents from all around the world using either NFC to read biometric passports/cards or through machine reading.

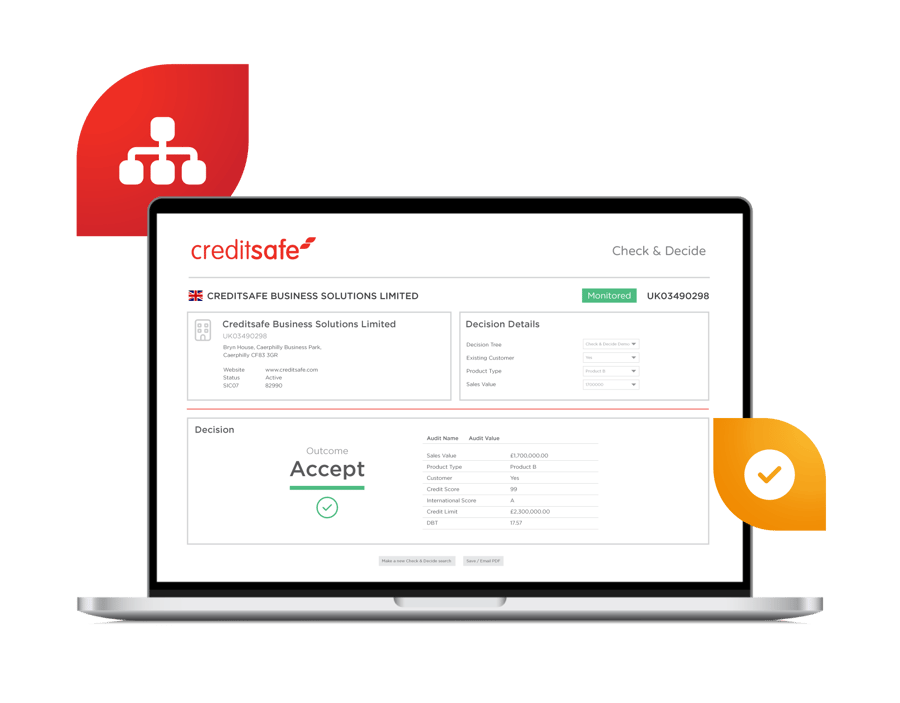

Check & Decide

Create bespoke workflows that help streamline your KYC and KYB checks.

Streamline your KYC and KYB checks with Creditsafe’s Check & Decide, our no-code platform that automates your business and compliance checks effortlessly. Leverage data from over 200 sources to cut decision-making time from hours to minutes.

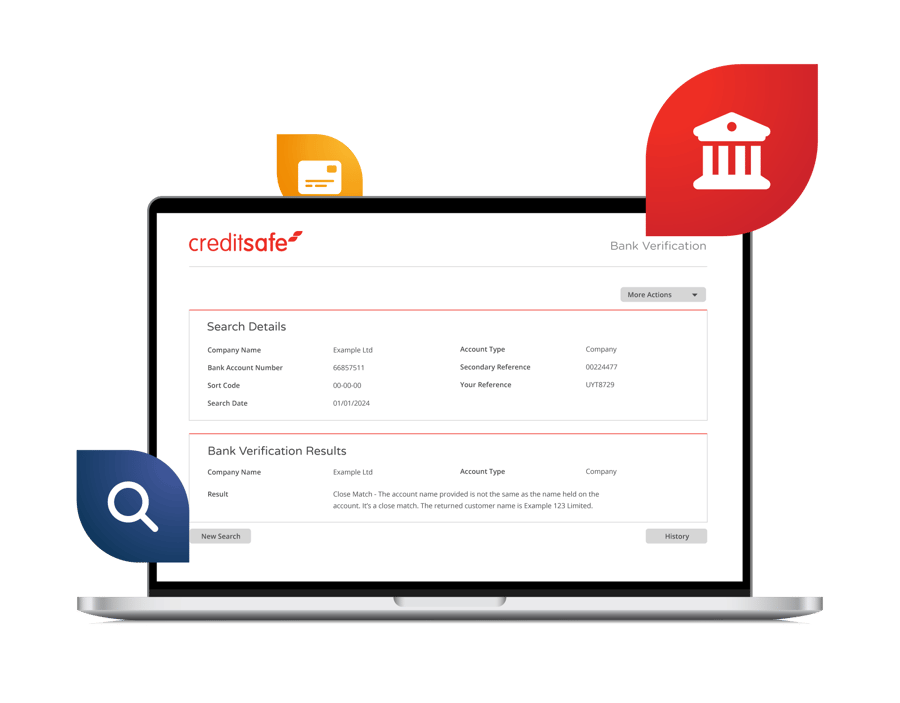

Bank Verification

Securely perform payment transfers to verified recipients.

Instantly validate sort codes, account numbers, and address details with our Confirmation of Payee-powered bank account verification platform. Reduce delays from incorrect information and combat identity fraud by confirming customer account details.

Connect API

Access a world of business and compliance data in a way that suits you and your business.

-

Website

Our web-based platform gives you instant access to consumer and global company credit risk information.

-

API & Integrations

Auto-populate web forms and automate decisions by integrating our data with your website, CRM or ERP systems.

-

Bulk Index Files

Receive scheduled exports of comprehensive commercial credit data in bulk. Perfect for re-sellers and data partners.

-

Bespoke Data

Customised exports of our global company and director database to suit your business needs and requirements.